US

While global markets fell after Iran retaliated against the US, investors are urged to remain cautious as the situation escalates....

Chinese and US tech firms are still a necessary part of the best performing global equity funds, although one fund sold off their Alphabet stock....

Global fund managers are becoming more defensive in their asset allocation, according to Bank of America Merrill Lynch, as they adjust to the geopolitical environment. ...

As central banks worldwide fight with low or even negative rates, advisers should look towards higher-quality investment grade bonds and emerging market debt to seek out ...

Nearly half of investors do not expect the US/China trade war to be resolved, according to a global fund manager survey by Bank of America Merrill Lynch....

Lazard’s Ron Temple explores the various potential US/China trade war scenarios and what they would mean for investment outcomes. ...

Global markets are entering a ‘late cycle’ phase, as demonstrated by interest rate cuts, according to RARE Infrastructure....

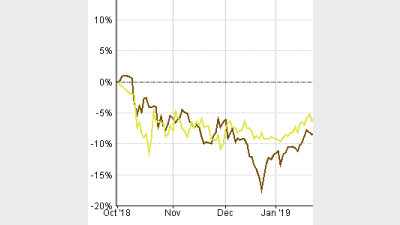

The Australian stock market fell by more than 3.5% last week over fears of escalations in the US/China trade war. ...

Insight, part of BNY Mellon, believes there is only a ‘low probability’ of the US/China trade war being resolved soon as it identifies six areas which could be drawn into...

With President Trump threatened with impeachment and Boris Johnson handling Brexit in the UK, AMP Capital’s Diana Mousina examines how these political developments impact...

The US/China trade war may be dragging on, writes Laura Dew, but are we really facing the threat of a global currency war and will either side be a winner at the end?...

The US has few options available to it if it tries to get into a currency war with China, according to analysis from State Street Global Advisers....

The trade tensions between the US and China are expected to continue to shake up markets, according to RARE Infrastructure....

Laura Dew writes that the Global sector offers investors exposure to a wide-ranging set of worldwide themes that would be ‘impossible’ for them to access otherwise....

Hexavest is standing by its conviction of being underweight US technology stocks, in the belief the companies are failing to live up to expectations....

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...