Super funds need to review alternative operating models

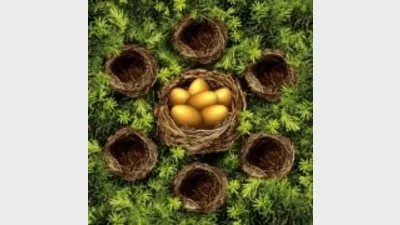

Superannuation funds need to adapt and review alternative operating models as pressure from regulatory scrutiny, greater competition, and lower growth increases, according to a Mercer report.

Mercer’s ‘Pathways to success’ whitepaper said super funds needed to be proactive in making decisions about their futures before the industry regulators took charge.

Mercer Australia director and chief executive, Ben Walsh, said: “While the scale test is in a state of policy evolution, funds need to take affirmative action and take control of their destiny, rather than being pushed into action – change or be changed”.

Mercer’s research suggested that around 36 per cent of super funds needed to take serious action now to ensure they continued to deliver member benefits long into the future.

It said that funds that were experiencing negative member benefit flows would also be in the Australian Prudential Regulation Authority’s (APRA’s) line of sight. Mercer said that of funds with $1 billion or less of funds under management (FUM), 56 per cent experienced negative net member benefit flows in the past year.

“What we can start to see is a downward spiral,” Walsh said. “As the number of members decline, average costs naturally increase. Funds then have to adopt more conservative investment strategies with the need for higher levels of liquidity, resulting potentially in lower rates of return.”

Walsh also noted that the ability for members to switch funds was getting easier.

“Therefore, it has never been so important for funds to truly understand their members and deliver experiences that meet their needs,” he said.

The report noted that for some smaller funds, self-sufficiency might no longer be an option and better member outcomes could lie in a strategic industry alliance.

Recommended for you

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.