Is the market in a sucker’s rally?

Despite the market falling upon news of President Trump’s positive COVID-19 result, it was a quick turnaround for Australian markets last week but it could be a “sucker’s rally”, according to Wealth Within.

Dale Gillham, chief analyst at Wealth Within, said the question being asked was whether this was a strong, sustainable move up or a sucker’s rally?

“I know I have said before that a week can be a long time in the market and this week has been no exception,” Gillham said.

“Last Friday we were looking at the market falling, as it was weak after President Trump was diagnosed with COVID-19.

“A few days later and the President is out of hospital and the Australian market has moved up in its strongest rise since May.”

Gillham said while it is possible that the All Ordinaries Index had already traded down to the low he was expecting, and would therefore continue to rise, it was probably a “sucker’s rally” before the market continued to fall away.

“Either way, we will know the answer next week. If the market trades up and closes above 6,400 points next week, we are likely to see further rises up to Christmas,” Gillham said.

“If it trades under 6,000 points, I expect the market to trade lower over the next few weeks to below 5,800 points and possibly as low as 5,400 points.”

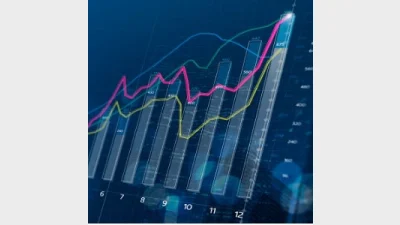

The All Ords index closed at 6,312.50 points on Friday afternoon and according to FE Analytics, had lost 4.85% since the start of the year to 9 October.

All Ords Index since the start of the year to 9 October.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.