Channel Capital and Bell AM enter distribution partnership

Multi-boutique investment firm, Channel Capital, and global equities asset management specialist, Bell Asset Management, have announced a strategic distribution partnership.

The agreement would aim to drive further engagement with research houses, financial advisers and wholesale/ sophisticated investors for its two strategies: global equity (Bell Global Equities Fund) and global small and mid-cap (Bell Global Emerging Companies Fund).

Channel Capital’s managing director, Glen Holding, said that Bell AM was selected due to the high alignment to its own qualities and value proposition in terms of its investment process, active returns, the quality of its investment team as well as domestic and offshore institutional investor support.

“In addition, with ‘growth ‘and ‘value’ offerings being quite overcrowded, we are of the view that the Bell Asset Management ‘quality at a reasonable price’ process that has delivered world class numbers to investors to date, will have a distinct role to play in our clients’ portfolios,” he said.

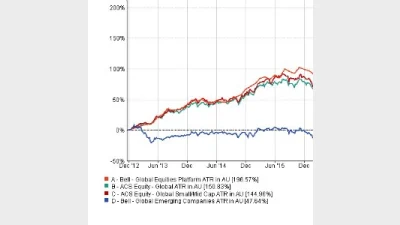

During the year to 31 August 2019, the Bell Global Equities Fund, which invested in a globally diversified portfolio of shares, delivered a return of 14.22% and outperformed its benchmark MSCI World ex Australia Index by 6.65%.

Over the same period, the Bell Global Emerging Companies Fund, which invested in a globally diversified portfolio of small and mid-cap companies, returned 10.07% and outperformed the benchmark MSCI World SMID Index by 8.99%, net of fees, the firm said.

Bell Global Equities fund and Global Emerging Markets fund performance vs benchmarks since inception

Recommended for you

Nuveen has made its private real estate strategy available to Australian wholesale investors, democratising access to a typically institutional asset class.

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.