O’Dwyer again blames bad advice for FASEA creation

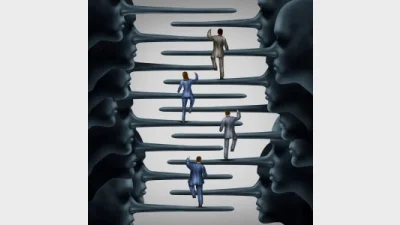

The Minister for Revenue and Financial Services, Kelly O’Dwyer has reiterated that the Financial Adviser Standards and Ethics Authority (FASEA) is the product of planners having delivered persistently bad advice.

At the same time as confirming the release of the latest transition pathways guidance by FASEA, O’Dwyer repeated her assertion that planners needed to remember why FASEA had been necessary – “repeated instances of inappropriate or just plain bad advice has significantly eroded trust and confidence in the financial advice sector”.

“Every adviser has a role to play in rebuilding that trust, and these new educational requirements are a critical step towards professionalising the sector,” she said.

“Ultimately, the professionalisation of the advice sector will be in the best interests of all advisers, existing and new, because it will ensure enduring consumer trust and confidence in the financial advice sector.”

Recommended for you

A strong demand for core fixed income solutions has seen the Betashares Australian Composite Bond ETF surpass $1 billion in funds under management, driven by both advisers and investors.

As the end of the year approaches, two listed advice licensees have seen significant year-on-year improvement in their share price with only one firm reporting a loss since the start of 2025.

Having departed Magellan after more than 18 years, its former head of investment Gerald Stack has been appointed as chief executive of MFF Group.

With scalability becoming increasingly important for advice firms, a specialist consultant says organisational structure and strategic planning can be the biggest hurdles for those chasing growth.