Morrison cites ‘dodgy advice’ in crackdown justification

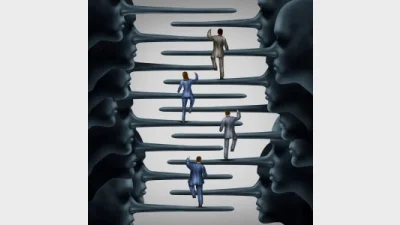

Federal Treasurer, Scott Morrison has referenced cracking down on the provision of “dodgy financial advice” as part of his broader justification for imposing both a bank levy and the Banking Executive Accountability Regime.

In a statement released just ahead of introducing the necessary legislation to the Parliament, Morrison emphasised the necessity of the Budget measures to help crack down on undesirable practices within the major banks.

He said that under the new regime, the Australian Prudential Regulation Authority (APRA) would have the powers to take court action to impose new civil penalties for breaching the expectations on how a bank conducts its business.

“In the most serious examples of reckless behaviour, this penalty could be up to $200 million,” he said.

“If a scandal is caused by bank executives, APRA will be able to step in and not only scrutinize the actions of those individuals, but hold the bank responsible for not supervising their managers properly,” Morrison said. “These new measures are in addition to the powers we will gave the Australian Securities and Investment Commission (ASIC) to crack down on dodgy financial advice and lending to people who can’t really afford it.

“And we will make it simpler and fairer for those feeling let down by their bank or financial institution, through the creation of the Australian Financial Complaints Authority - a one-stop shop for customers to access free, fast and binding dispute resolution services.”

Morrison’s statement came after the APRA chairman, Wayne Byres had told a Senate Estimates Committee hearing that the regulator already possessed many of the powers outlined by the Government.

“…many of the measures involve a strengthening of APRA’s existing powers, rather than completely new additions to APRA’s armoury,” he said. “APRA already has, for example, a fit and proper regime covering senior executives, powers that allow for the disqualification of individuals, and a capacity to set and enforce standards for remuneration policies.”

However he acknowledged that the proposals announced in the Budget would considerably strengthen those powers, particularly as they apply to banks.

Recommended for you

Equity offerings should be “seriously considered” by advice firms if they want to attract experienced advisers with the option viewed as a major differentiator for candidates seeking their next role.

DASH Technology Group has enacted two internal promotions, appointing a chief risk officer and chief commercial officer to strengthen the firm’s governance and operational capabilities.

The Stockbrokers and Investment Advisers Association has announced the appointment of its new chief executive following the exit of Judith Fox after six years.

Insignia Financial has appointed an experienced financial advice leader as head of education and advice on its Master Trust business, who joins from Ignition Advice,