Independence at heart of Centric Wealth transaction

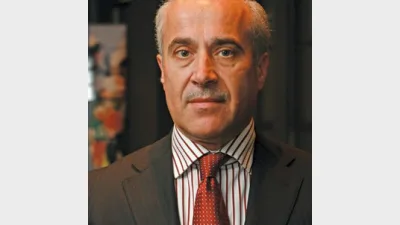

Centric Wealth's underlying philosophy to remain non-aligned represented one of the key foundations for its acquisition by Financial Index Wealth Accountants, according to Financial Index chief executive Spiro Paule.

Discussing the acquisition move with Money Management, Paule said that while there had been speculation of an acquisition play by a major financial services institution, the message Financial Index had received loud and clear from Centric was that it wanted to remain non-aligned.

He said this accorded with the independent philosophy which sat at the heart of the Financial Index approach.

The Financial Index acquisition of Centric is being backed by major private equity player KKR Asset Management which will hold a 30 per stake, but Paule said the day-to-day running of the business would be left to Financial Index and Centric.

The two companies announced the acquisition process on Sunday, saying that Financial Index had entered into a Bid Implementation Agreement under which it had agreed to acquire all outstanding ordinary shares issued by Centric Wealth by way of an off-market takeover bid.

It said that under the terms of the Offer, Centric Wealth shareholders would be entitled to receive 8.9 cents cash per ordinary share, with the offer being endorsed as fair and reasonable by the Centric Wealth Board.

The acquisition process is not expected to be completed until the middle of March and it is expected that the future management structure of Centric Wealth will become clearer in that time.

Recommended for you

ASIC has released the results of the latest financial adviser exam, held in November 2025.

Winners have been announced for this year's ifa Excellence Awards, hosted by Money Management's sister brand ifa.

Adviser exits have reported their biggest loss since June this week, according to Padua Wealth Data, kicking off what is set to be a difficult December for the industry.

Financial advisers often find themselves taking on the dual role of adviser and business owner but a managing director has suggested this leads only to subpar outcomes.