PROFESSIONAL INDEMNITY INSURANCE

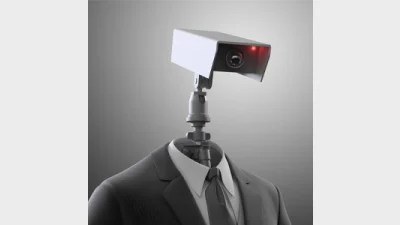

Professional indemnity insurance premiums are rising because fewer insurers are participating in the market and questions are being asked about whether small, self-licens...

Amid the fall-out from the Royal Commission, Honan Insurance has warned that underwriters are becoming increasingly wary of professional indemnity insurance....

The Association of Financial Advisers has warned that the new Australian Financial Complaints Authority regime is likely to drive up professional indemnity insurance prem...

Advisers transitioning away from vertically integrated models should consider a co-operative group instead of self-licensing to avoid inherent risks. ...

ASIC has cancelled the Australian financial services license held by Marigold Falconer International Limited....

Accountants who provide SMSF advice without a licence risk not being covered by professional indemnity insurance, as insurers treat accountants and financial advisers dif...

The idea of a last resort compensation scheme is again being canvassed in Canberra but it is something that should not occur in isolation to fixing the PI insurance regim...

The Financial Ombudsman Service (FOS) has again pointed to the inadequacy of professional indemnity insurance, as unpaid compensation from its rulings approaches $15 mill...

As risk planning remains a hot topic in the financial advice space, Malavika Santhebennur explores the top 10 legal quandaries planners can find themselves in and how to ...

The Fold Legal claims accountants are not adequately prepared when applying for AFS licences....

Questions are being raised about whether accountants who access limited licensing arrangements will accept conventional licensee remuneration models....

ASIC deputy chairman, Peter Kell, says the regulator will be taking a clsoe look at professional indemnity insurance in coming months....

With a third of FOS determinations going unpaid the efficacy of Professional Indemnity insurance as a compensation mechanism is under question and, as Mike Taylor reports...

ASIC acknowledges that vertical integration gives rise to conflicts of interest but acknoweldges that scale has benefits....

Licensees operating under AAP dealer services model will be offered succession planning, acquisition funding and client book purchasing support as part of a suite of new ...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...