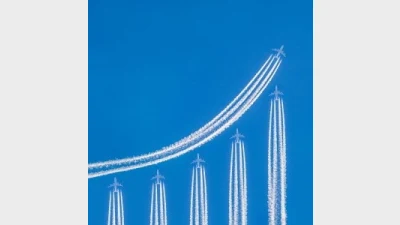

Strong outlook for Challenger platforms

The outlook for Challenger platforms will remain strong as net fund flows favour the non-aligned platforms, according to Powerwrap’s chief executive, Will Davidson.

The platform, which offered a range of alternative investments, has an average portfolio of around $1.4 million each, with more than 435,000 high net worth investors in Australia who were responsible for $1.72 trillion in investable assets.

Funds under administration (FUA) increased 22 per cent between FY17 and FY18 to $7.8 billion, as of the end of September quarter.

According to Davidson, headwinds from the Royal Commission’s scrutiny of the vertically integrated wealth management business model had the potential to drive growth of non-bank platform providers.

“Net funds flows are clearly favouring the challengers and this is likely to continue,” he added.

Davidson also said that the turnkey services were particularly attractive to advisers looking to set up more independent operations.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.