Perennial sees strong demand for unlisted space

Strong demand from wholesale investors interested in the unlisted space has seen Perennial Value’s pre-IPO Opportunities Fund attract $50 million only weeks after it announced plans for a new Private to Public Opportunities Fund, the firm said.

The new fund, which would close on 16 August, would be an extension of the firm’s Microcap Opportunities Trust which invested primarily in private companies that became public.

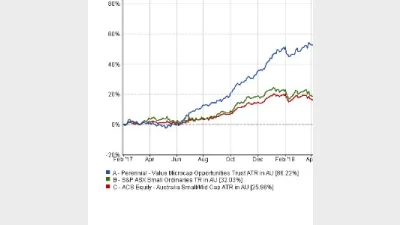

The microcap fund reached the targeted capacity of $200 million and closed, returning 30.4 per cent per annum net of fees since inception.

Perennial’s managing director, John Murray, said: “We’ve been very pleased by the strong demand from wholesale investors for this new fund, in particular high net wealth and family office investors”.

“They recognise there’s a gap in the market for opportunities to invest in early-stage companies requiring growth capital,” he said.

Performance of the Perennial Value Microcap Oppoeruntites Trust since 2017

Recommended for you

Real estate fund manager Centuria Capital has acquired Arrow Funds Management, a specialist agriculture fund manager.

Perpetual has raised $267 million for its Credit Income Trust following strong demand to capitalise on a pipeline of corporate loan opportunities.

The future strategy and management for the $444 million Platinum Capital listed investment company has taken another turn at the LIC’s annual general meeting.

A new funds distribution business has launched in Australia, seeking to bring institutional offerings to the wholesale market and led by co-founder of Jamieson Coote Bonds.