Bell AM hits three-year milestone

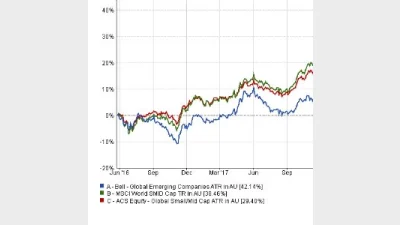

Bell Asset Management has announced it has hit a key milestone with its Global Small and Mid-Cap offering, Bell Global Emerging Companies Fund, reaching a three-year track record.

The fund invested in a diversified portfolio of 35-55 global small and mid-cap companies across different geographies, including North America, Europe and Asia.

Commenting on the milestone, Bell’s chief investment officer, Ned Bell, said: “Bell Asset Management has been researching and investing in global small and mid-cap (SMID) stocks since 2003 and over this time, we have developed a comprehensive and in-depth understanding of the SMID Cap landscape.

“Since launching the Bell Global Emerging Companies Fund in June 2016, we have outperformed the MSCI World SMID Cap benchmark, highlighting our depth of knowledge in this area and our robustness and ability to perform well in periods of heightened volatility.”

According to Bell, global SMID stocks also had less valuation risk than large cap growth stocks, less absolute risk than emerging markets and less liquidity risk than small caps.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.