Synchron rallies against 'socialist' agenda

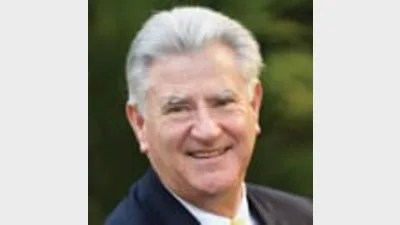

Synchron is encouraging its advisers to lobby their local politicians against the proposed Future of Financial Advice (FOFA) reforms, which Synchron director Don Trapnell (pictured) says panders to the union super funds movement’s “socialist” agenda.

The FOFA reforms unfairly disadvantage and penalise financial advisers operating outside of super funds, making it more difficult for them to do business, he said.

“Adviser fines in the vicinity of $200,000; lifetime bans; criminal penalties; bans on commissions on life insurance products inside superannuation; bans on corporate sponsorship of overseas adviser conferences: all [of these factors] serve to disadvantage financial advisers operating outside union superannuation funds,” Trapnell said.

The reforms will ultimately mean consumers have fewer choices about where they access advice and where they place their superannuation money, he said.

Recent comments from Industry Funds Management chair Garry Weaven suggesting the industry fund movement will be “coming after” the self-managed superannuation fund sector once the FOFA debate settles down shows it is not interested in consumers but in controlling the nation’s super savings, Trapnell said.

“It is a gross demonstration of union fund greed,” he added.

Trapnell also criticised the proposed ban on corporate sponsorship of overseas adviser conferences.

“Any such proposed ban is only likely to affect [Australian Financial Services Licence] holders and their authorised representatives. It probably will not, for example, affect delegates attending the Australian Institute of Superannuation Trustees’ Global Dialogue in London next year,” he said.

The Government may be using financial services product failures as an excuse to put through reforms that have the potential to put boutique advisers out of business, but it was unclear how the changes would prevent a future product failure like Westpoint or stop a fee-for-service business like Storm Financial from failing again, he said.

Trapnell urged advisers to take action against what Synchron described as an ongoing and concerted attack on the financial advice industry.

“Advisers must stand up against Government attempts to dictate how ordinary Australians go about their business. They need to talk to their local Members of Parliament – and any other Federal politician who will listen – about the devastating impact FOFA will have on them, their clients, their businesses and the industry.”

Recommended for you

The top five licensees are demonstrating a “strong recovery” from losses in the first half of the year, and the gap is narrowing between their respective adviser numbers.

With many advisers preparing to retire or sell up, business advisory firm Business Health believes advisers need to take a proactive approach to informing their clients of succession plans.

Retirement commentators have flagged that almost a third of Australians over 50 are unprepared for the longevity of retirement and are falling behind APAC peers in their preparations and advice engagement.

As private markets continue to garner investor interest, Netwealth’s series of private market reports have revealed how much advisers and wealth managers are allocating, as well as a growing attraction to evergreen funds.