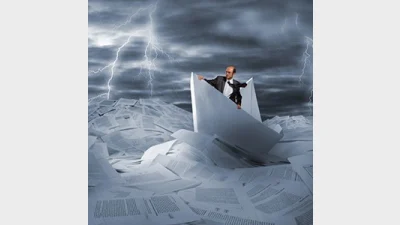

MARKET VOLATILITY

What are the benefits of using a commodity trading adviser (managed futures) fund in a portfolio? What is a reasonable allocation, and where should that allocation come f...

iShares Australia's Tom Keenan debunks the myths about the causes of market volatility....

Australian investors remain pessimistic about the prospect of full market recovery, with their concern levels rising while return expectations are decreasing....

Fidelity’s Tom Stevenson explores some of the questions clients ask their financial advisers – and provides the answers....

Select Asset Management's Dominic McCormick suspects the recent decline in currency volatility is the calm before a much bigger storm – with significant implications for ...

AMP Capital's Craig Keary warns investing in term deposits may prevent investors reaching their financial goals and suggests other ways to find yield....

Taking a multi-asset approach can level out an investor's income profile, according to Goldman Sachs portfolio manager Angus Bell....

The platform market suffered yet another fall over the last year, with net fund flows reaching their lowest levels in 10 years....

Global macro investing and hedging behaviour is having an increasingly significant impact on equity markets, according to Standard Life Investments....

Government bonds in developed countries are no longer the 'risk-free' assets they once were, according to senior Franklin Templeton bond manager Michael Hasenstab....

Most financial planning principals have felt the need to reduce costs within their businesses, according to a survey conducted by Money Management....

Investors’ love affair with cash could be heading for heartbreak if they don’t diversify, according to head of Australian Unity Investments, David Bryant....

Rahul Guha uses his experience as an accountant to provide a few tips on how to manage profit in uncertain times....

Research approves active management within volatility strategies....

Julian Robertson suggests a practical strategy when introducing money into the market and another for managing existing portfolios....

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...