ATO

While experts appear to be urging SMSF investors away from cash, CANSTAR's Chris Groth believes there may be more to that ‘long-term marriage' with cash than people might...

ATO data points to fewer excess contributions breaches in 2011-12, but some are finding their way to the SCT....

Mike Taylor writes that it is passing strange that the Government has allowed a debate around the super taxes for upper income earners when it has failed to implement a v...

Even if an application made to the ATO is successful, the associated costs can significantly reduce the net proceeds the taxpayer receives - which can lead to unfair outc...

Lawyer Peter Townsend questions whether concessional tax settings are prejudiced against businesses using SMSFs....

Irina Tan and Bryce Figot from DBA Lawyers explain the intricacies around dealing with the Australian Taxation Office and handling contraventions. ...

Lawyer Peter Townsend questions whether concessional tax settings are prejudiced against businesses using SMSFs....

David Shirlow from Macquarie Adviser Services brings you up to date with new developments regarding the way SMSF trustees can structure insurance....

Michael Hallinan from Townsends Lawyers explains the rules around changing your holding trustee in a LRBA....

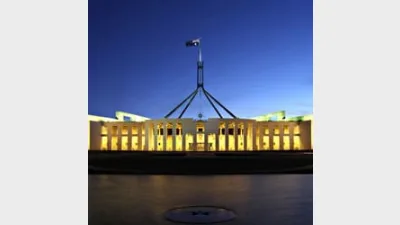

Australia’s new Tax Commissioner signals fewer high-profile court cases....

With a growing number of SMSFs drawing income streams, failure to meet the minimum pension obligations within a financial year could deny a fund all or some of its tax ex...

Mike Taylor writes that recent actions on the part of both ASIC and APRA suggest that the SMSF sector has become too large for any of the regulators to ignore....

Mike Taylor writes that recent actions on the part of both ASIC and APRA suggest that the SMSF sector has become too large for any of the regulators to ignore....

MLC's Mansi Desai explains how small business owners could transfer a business real property into their SMSF and benefit from various CGT concessions. ...

ASFA supports the ATO levying SMSFs to cover compliance costs but insists on transparency of process....

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...