ASFA supports ATO levy on SMSFs

The Australian Taxation Office (ATO) should be able to raise a levy against self-managed superannuation funds (SMSFs) to recover the costs of its supervision, but it should be required to fully disclose how much that supervision actually costs.

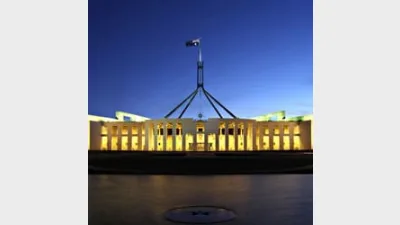

That is the assessment of the Association of Superannuation Funds of Australia (ASFA), which has used a submission to a Parliamentary Committee to signal its support for the ATO being able to use a levy to recover supervisory costs.

However it said that levy should not then be used by the Tax Office to become a "cost recovery mechanism for the provision of taxation services to SMSFs (lodging returns, responding to taxation issues etc)".

"ASFA believes that it would be useful for the ATO to publish each year SMSF levy income collected each year and details of the costs incurred in supervision of SMSFs for the purposes of regulatory supervision," the submission said.

ASFA said it had previously raised concerns with respect to agencies such as the ATO and the other financial services regulators being funded by way of levies.

"The most significant aspect of agencies being primarily funded by levies is that it represents a form of moral hazard, in that the party which is providing the funding (industry) has no control over the resourcing decisions made by the agency," it said.

The ASFA submission said this extended to the type, and in particular, the scope of activities engaged in by the agency and the quantum, and nature, of the resources used.

"As such, there is limited input by those impacted by the levy in the way of effective oversight, checks and balances and controls to ensure that the activities performed, the resourcing utilised and the resultant costs incurred are appropriate and reasonable," it said.

Recommended for you

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.

SuperRatings has shared the median estimated return for balanced superannuation funds for the calendar year 2024, finding the year achieved “strong and consistent positive” returns.