SISFA calls on SMSF voting power

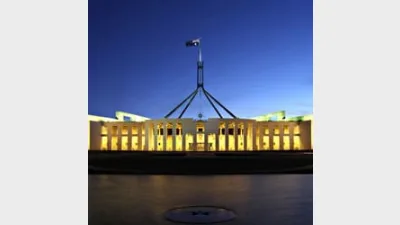

The Small Independent Superannuation Funds Association (SISFA) has warned the Federal Government that the country's almost one million self-managed super fund (SMSF) trustees will use their collective voting power to object to further regulatory burden.

The latest Australian Taxation Office (ATO) statistics found there are now around 913,000 SMSF members in Australia, and politicians should be wary of people power from these voters, according to a SISFA statement.

SISFA director Darren Kingdon said those members did not want further structural change to the running of their SMSFs, nor to have their funds "raided" by the Government through tax on unrealised capital gains.

Those voters should be very concerned about any "cash grab" on their SMSF and object strongly to their local member, the association stated.

"Federal politicians should think hard about the advice coming from union-oriented advisory groups regarding the regulation of SMSFs by the ATO and taxing small funds separately from large funds," Kingdon said.

One of the union arguments has been that SMSFs should be taxed on unrealised capital gains in the interests of "fairness", Kingdon said.

"Has anyone seen a large fund pay tax to the ATO on unrealised gains before sale? They might bring it to account in calculating member balances, like SMSFs, but do they really pay it?" he said.

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.