Regulation stymieing retirement income product market

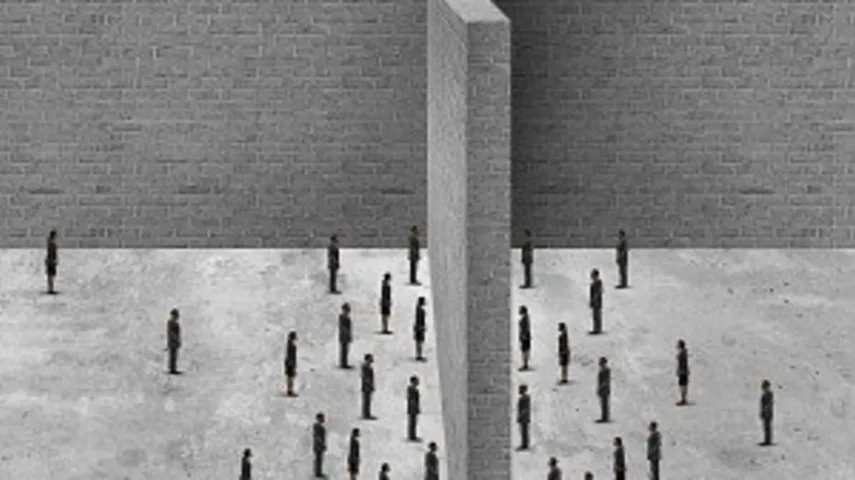

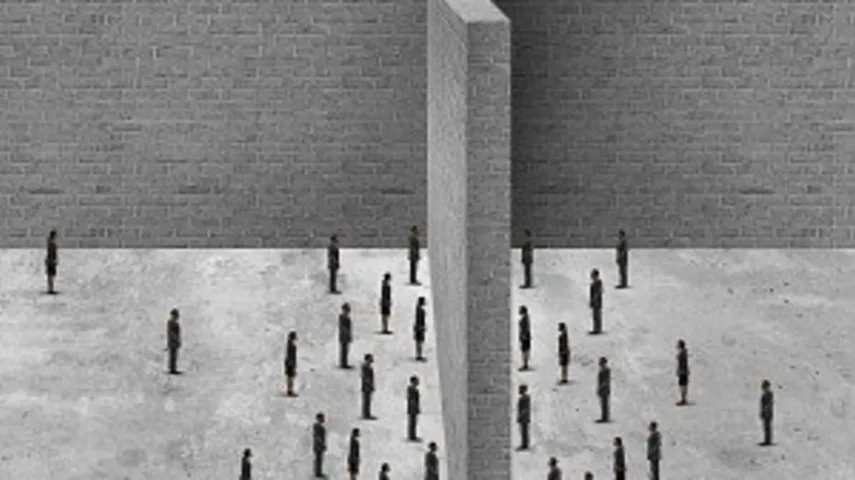

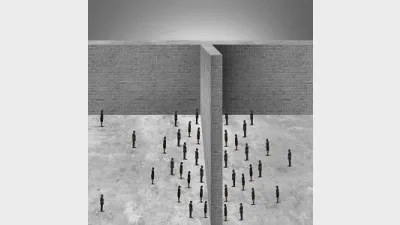

Despite Australia having a limited retirement income product offering compared to other developed countries, a regulatory framework created over two decades ago stymies companies wanting to launch new offerings.

Head of distribution for Allianz Retire+, a relatively new player on the post-retirement product stage, Catriona Wortley, yesterday told delegates at a Lonsec Symposium that the biggest issue the company faced in entering the Australian market was navigating its regulatory framework.

“Getting all the legislation, the Superannuation Industry Supervision (SIS) Act and Life Insurance Framework legislation, to work together for quite an innovative product was challenging,” she said, and took far longer than Allianz Retire+ had originally anticipated.

Wortley said that this “was not surprising at all”, however, “considering we have regulation that was put in place in the nineties”.

The SIS Act was enacted in 1993, while the LIF came into force in 1995.

Wortley also said that the providers faced commitment issues when bringing retirement products to the Australian market, needing to take a more long-term perspective when launching new offerings, and that there were distribution issues for such products in Australia.

Recent research by Allianz Retire+ found that people fear running out of money in retirement more than death however, and Wortley observed that the depth of retirement products on offer in Australia was “pretty poor”, emphasising the importance of improving the barriers faced by new offerings in the retirement income space.

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.