ASFA calls for gig economy super solutions

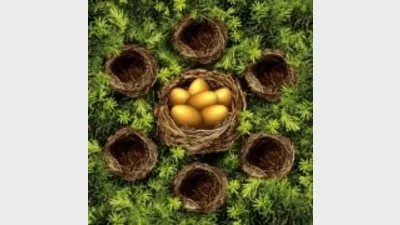

With the rise in number of gig workers, the Association of Superannuation Funds of Australia (ASFA) has called for legislative reform to ensure shifts in the economy would not unruly impact retirement planning for many individuals.

According to ASFA’s chief executive, Martin Fahy, the super settings for gig economy should be fixed as soon as possible.

Therefore ASFA’s pre-budget submission focused in particular on: the need for a new ‘dependent contractor’ category within the legislative framework for the superannuation guarantee (SG), tougher sham contracting penalties, SG for the self-employed and an elimination of the $450 threshold for entitlement to the SG.

Fahy called that ASFA recommendations to be “achievable and fair” and called on the government to support them.

“With the rise of the gig economy, how people work is likely to become more varied,” he said.

“Gig economy platforms continue to show exponential growth so we need to ensure those involved are not losing out on super. The gig economy should be part of the solution for funding retirement rather than a problem.

“In the future there is likely to be more work but fewer permanent, full-time jobs, so these challenges must be met to bring everyone forward in the economy.”

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.