Which are the top five fixed income funds?

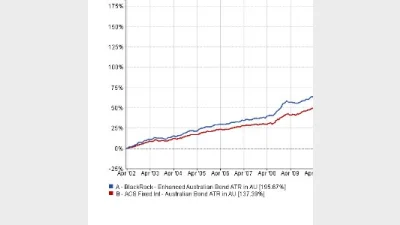

An active and a passive fund have achieved the same returns over five years, making them the joint best-performing funds in the ACS Fixed Interest – Australia Bond sector.

Over five years to 6 September 2019, the BlackRock Enhanced Australian Bond fund returned 5.62% on an annualised basis while the Macquarie True Index Sovereign Bond fund also returned 5.62% over the same period.

The remainder of the top five in the sector was all in active funds; the Macquarie Core Australian Fixed Interest fund with returns of 5.60%, Mercer Australian Sovereign Bond with 5.57% returns and, in fifth place, the QIC Australian Fixed Interest fund which returned 5.45% on an annualised basis.

Launched in 2002, the BlackRock Enhanced Australian Bond fund aims to achieve superior performance through providing returns that exceed the UBS Compositive Bond All Maturities Index over rolling three years.

Meanwhile, the passive Macquarie True Index Sovereign Bond fund, which was launched in 2009, holds over three quarters of its assets in Australian government bonds with the remaining 21% in general Australian fixed interest.

A second Macquarie fund also made the top five in the shape of the Macquarie Core Australian Fixed Interest fund in third place which was launched in 2005.

The Mercer Australian Sovereign Bond fund aims to outperform the Bloomberg AusBond Treasury 0+ Year index over the medium term, achieving diversification by investing in a range of sovereign ratings and bond durations.

Lastly, QIC Australian Fixed Interest fund, one of four fixed interest funds run by the boutique, looked to invest in Australian securities but could include up to 50% in international ones.

When the returns were checked over three years, rather than five years, only the BlackRock fund and the Macquarie Core Australian Fixed Interest funds remained in the top five at third and fifth place respectively.

Recommended for you

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.

Philanthropic investment group Future Generation’s CEO, Caroline Gurney, will step down from her role at the start of next year.

The newly combined L1 Group is expectant of stabilising Platinum’s falling funds under management within the next 18 months, unveiling four growth pathways and a $330 million equity raise.

Janus Henderson Investors has launched a global small-cap fund for Australian investors, which includes a 5.4 per cent weighting to Australian equities.