Seer AM looks to raise $4 million

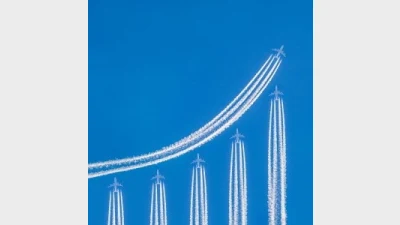

Seer Asset Management is seeking to raise $4 million in new capital to fund its further business growth and seed its specialist global equities Mega Trend fund, which has been built based on a multi-thematic investment philosophy.

The new investment vehicle, the Seer Mega Trend Fund, would invest in listed shares in Australia and overseas with a focus on extracting value from the mega trends identified by Seer.

The trends would include healthcare, agriculture, the rise of the individual, globalisation, energy and disruptive technology.

The offer included 40 million converting preference shares at $0.10 per share with a 10 per cent unfranked dividend and a free one-for-one option at $0.20, the firm said.

This means the offer, if fully subscribed, would see existing shareholders, including directors, retain around 43 per cent of the company.

According to Seer’s managing director, Steve James, the offer would also provide investors with the opportunity to become an early-stage investor in a multi-thematic fund manager with a clear growth path.

“As co-investors in both the manager and the underlying funds, investors will have exposure to a strong portfolio of the Mega Trends, SRI and global markets while also benefitting from the growth of the manager (Seer)," he said.

“Through extensive research our multi-thematic investment approach, applied across our investment strategies, includes identifying six world Mega Trends critically shaping the future and investment outcomes.”

Seer AM was set up by Australian stockbroking veteran Peter LeMessurier, former CommSec executive Steve James and head of investments Alice LeMessurier.

Recommended for you

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.

Global year-to-date inflows into active ETFs are 87 per cent higher than the same time a year ago at US$447.7 billion.