Netflix puts the N in FAANG

While the FAANG stocks’ competitive advantage might be shrinking as giants like Tencent and Alibaba grow, WCM Investment Management (WCM) sees continuing value in tech stalwart, Netflix.

The firm, which had contrarily sold out of four of the big technology stocks (Facebook, Amazon, Apple and Google) over the past few years, bought into Netflix, which co-chief executive officer and portfolio manager, Paul Black, attributes to its opportunity in emerging markets and developing countries.

“We couldn’t make the case that Amazon’s long-held competitive advantage is getting stronger vis a vis their competitors. Rather its competitive advantage is shrinking,” Black said. “While it’s still a great business, we look for organisations whose competitive advantage is increasing, not weakening.”

One of the reasons that Amazon’s competitive advantage was weakening, according to Black, was that its availability in Eastern Europe, Latin America and Asia was limited by the fact that consumers couldn’t get parcels safely delivered to their doors.

On the contrary, Black said, consumers in those markets could easily stream Netflix content, giving the company a competitive edge and, ultimately, greater growth potential.

Black said Netflix was also focused on developing a great corporate culture, which was important to a company’s health and future as any financial indicator.

“Companies with a positive workplace culture consistently deliver superior investment returns. Engaged employees keep customers happy and deliver consistently on business objectives which translates to higher sales and lower financial volatility,” Black said.

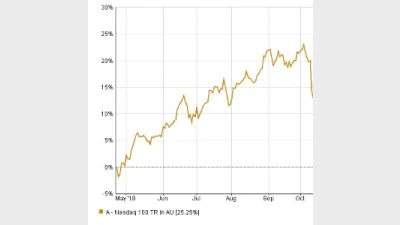

The chart below tracks the performance of the Nasdaq 100, which includes the FAANG stocks, for the 12 months to date.

Recommended for you

Nuveen has made its private real estate strategy available to Australian wholesale investors, democratising access to a typically institutional asset class.

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.

Specialist global equities manager Nanuk has celebrated 10 years of its flagship New World Fund and is actively considering its next possible vehicle.

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.