MDA operator fined for misleading advertising

Synergy Financial Markets had paid a penalty of $10,800 after the Australian Securities and Investments Commission (ASIC) issued it with an infringement notice for false or misleading statements on its website.

The firm trades equities and derivatives on behalf of its clients through the operation of two managed discretionary accounts.

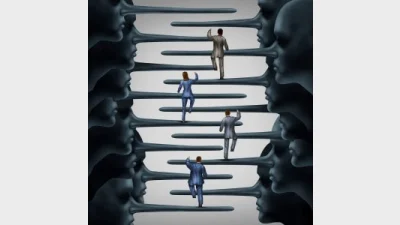

Synergy mentioned several times on its website that investors who invested in its managed discretionary accounts would only pay Synergy “when your account profits”.

ASIC said these statements were misleading because regardless of whether an investment in one of its managed discretionary accounts profits.

Synergy charges investors:

- In one of its managed discretionary accounts an annual management fee of two per cent of an investor’s balance; and

- Brokerage fees and commissions in both of its managed discretionary accounts.

Synergy has removed the statements from its website. The payment of an infringement notice is not an admission of a contravention of the ASIC Act consumer protection provisions. ASIC can issue a notice where it has reasonable grounds to believe the person or firm has contravened certain consumer protection laws.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.