Look at EMs to capitalise on global recovery

To capitalise on the global economic recovery investors should look at the emerging markets (EM) as they have growing populations and offer a chance to tap into some important consumption themes, according to Franklin Templeton’s active equity specialist investment manager Martin Currie.

One of the sectors that might pique investors’ interest at the moment in emerging markets was the semiconductor market, which globally approached US$500 billion ($641.8 billion), but faced concerns about a shortage of supply.

“The list of leading global semiconductor businesses is now dominated by emerging markets companies. They include Taiwan’s TSMC, which grew revenue 25% in 2020; South Korea’s Samsung Electronics and SK Hynix; and Taiwan’s Globalwafers,” Alastair Reynolds, portfolio manager of the Legg Mason Martin Currie Emerging Markets fund said.

Reynolds also point to the electric vehicle (EV) market as EV battery demand was expected to grow 10-fold over the next 10 years, and the majority of that growing demand was currently being met by Asian producers, including South Korea’s LG Chem and China’s CATL.

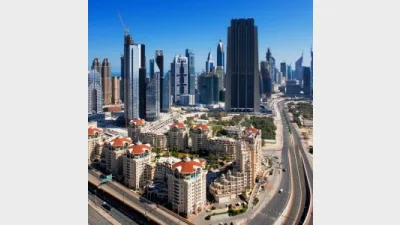

“Emerging markets provide access to young and growing populations and tap into some really important consumption themes, as well as themes that are driven by urbanisation and digitisation. Our fund provides access to highly profitable companies that are capable of delivering higher levels of growth,” Reynolds added.

The Legg Mason Martin Currie Emerging Markets Fund, which was launched in 2011, since inception produced an average return of 10.2% a year (net of fees), compared with average 9% annual growth of the benchmark over that period, the firm said.

Over the five years to the end of April, the fund returned 17.0% a year (net of fees), compared with the benchmark return of 12.2% a year. Over the 12 months to the end of April, the fund returned 32.0% (net of fees), compared with the benchmark return of 26.0%, the firm said.

“The team’s awareness of ESG issues was a key reason for its early position in the EV space. Now the team is finding opportunities further down the EV supply chain, including companies making the equipment used to produce the batteries,” Reynolds added.

Recommended for you

GQG Partners has marked its fifth consecutive month of outflows as its AI concerns lead to fund underperformance but overall funds under management increased to US$166.1 billion.

Apostle Funds Management is actively pursuing further partnerships in Asia and Europe but finding a suitable manager is a “needle in a haystack”.

Nuveen has made its private real estate strategy available to Australian wholesale investors, democratising access to a typically institutional asset class.

VanEck is expanding its fixed income range with a new ETF this week to complement its existing subordinated debt strategy which has received $1 billion in inflows this year.