Lennox takes advantage of IPO window

Small cap boutique Lennox Capital Partners has invested in two companies at an early stage in its Australian Microcap Fund after a ‘challenging year’ for IPOs.

The firm said it had met with 10 companies when the IPO window opened in July that were looking to raise money or list on the Australian Securities Exchange (ASX). These came from a range of areas including healthcare, technology and mining.

In a monthly report, managers James Dougherty and Liam Donohue said the two firms it had selected for the fund were financial technology company Sezzle and insurance software company Fineos. Sezzle, which was founded in 2016 in the US, was now one of the fund’s top active positions.

“Lennox Capital Partners applies its quality score to every prospective investment, making sure management and the board are aligned with shareholders to grow the company, clarity of earnings over the medium term and attractive valuation metrics.”

“Newly-listed Sezzle Inc rose 123.8 per cent from its listing price of $1.22. We invested in the company at IPO based on the company's attractive market opportunity in the USA. We like the industry and believe the company is only at the beginning of its growth phase – adding customers in the US, increasing the number of participating merchants and driving increased basket sizes.

“Given that Sezzle trades on a significant discount to Afterpay and we believe has less regulatory risk (the company does full credit checks on its customers), we think there is still plenty of upside to the valuation.”

The short IPO window before the full-year reporting season in August followed a ‘challenging’ time for IPOs in 2018 as a result of volatile markets and complicated political backdrop. The manager duo were doubtful how long this year’s season would last given the market environment.

“Given the increased level of volatility in the stockmarket in early August and ongoing uncertainty around global interest rates and a possible trade war between China and the US, the IPO window may prove to be open for a limited time only.”

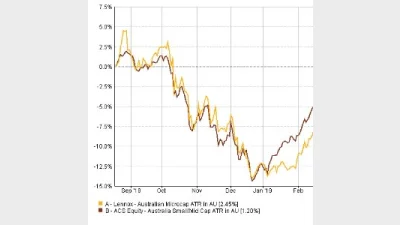

The $12.5 million Australian Microcap Fund has returned 2.4 per cent over one year to 20 August, 2019, according to FE Analytics, versus average returns of 1.2 per cent for the ACS Equity- Australia Small/Mid Cap sector.

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.