ETFs take lead in Australian equity income sector

Three of the top four Australian equity income funds were exchange-traded funds, contrasting the Australian equity sector where active funds dominated the top five.

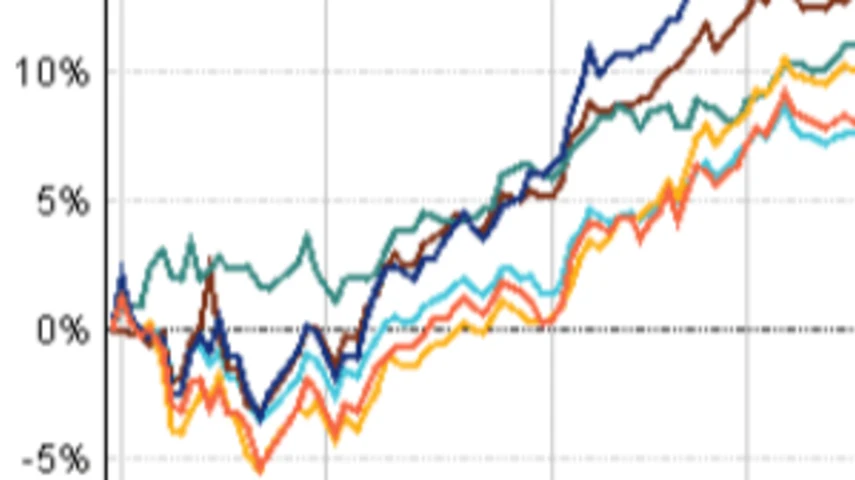

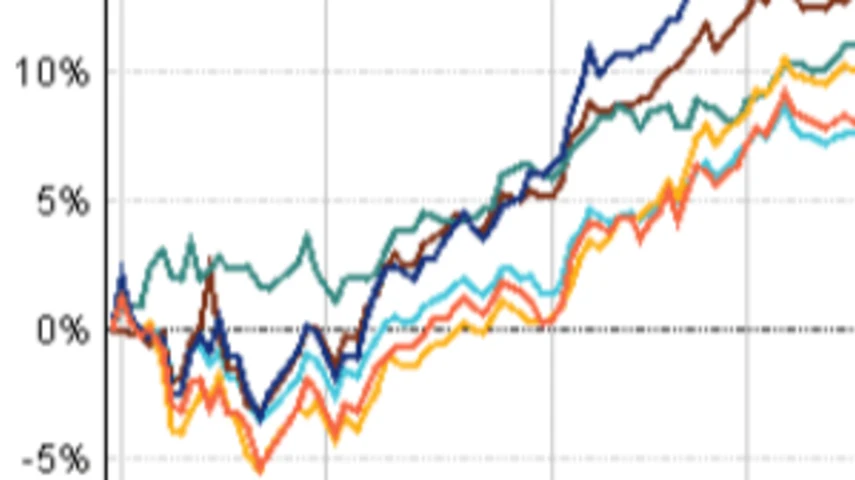

According to FE Analytics, within the Australian Core Strategies universe, the Australian equity income sector returned 18.83%, year to 29 November, 2019.

The best performing funds were UBS IQ Morningstar Australia Dividend Yield E (32.88%), Ausbil Active Dividend Income Wholesale (28.75%), BetaShares Legg Mason Real Income ETF (27.08%), BlackRock iShares S&P/ASX Dividend Opportunities ETF (26.14%) and Legg Mason Martin Currie Equity Income X (23.57%).

UBS replicated the performance of the Morningstar Australia Dividend Yield Focus Index, Betashares replicated the S&P/ASX 200 and BlackRock replicated the S&P/ASX Dividend Opportunities Accumulation Index.

Top holdings for UBS were Wesfarmers (10.10%), Woolworths (7.7%), Transurban (7.2%), IOOF (5.5%) and Sydney Airport (5.2%), as at 30 November, 2019.

Top holdings for Ausbil were CBA (10.01%), CSL (8.52%), HBP (7.99%), Macquarie Group (4.66%) and NAB (3.62%), as at 31 December, 2019.

Betashares’ sector weightings were retail – property (29.3%); other – property (26.2%); utilities (18.8%); telecom, media and technology (15.1%); industrial – property (5.6%) and offices – property (5%), as at 31 December, 2019.

BlackRock’s top holdings were Wesfarmers (10.83%), Woodside Petroleum (10.29%), CBA (9.83%), Rio Tinto (9.76%) and BHP (9.48%), as at 31 December, 2019.

Legg Mason Martin Currie’s top holdings were JB Hi-Fi (4.42%), Telstra (3.88%), Australian Gas Light Company (3.79%), Wesfarmers (3.65%) and Woodside Petroleum (3.46%).

Best performing Australian equity income funds v sector over the year to 30 November 2019

Recommended for you

Schroders has appointed a new chief executive as Simon Doyle steps down from the asset manager after 22 years.

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.