EMs dragged down by Argentina

Political fears meant Argentina lost 48% during August, dragging down the wider emerging markets index.

According to Franklin Templeton, Argentina was the worst market globally during the month following President Mauricio Macri’s poor performance in primary elections and fears of a populist victory in October’s elections.

Argentina was recently upgraded by index provider MSCI from a frontier market to emerging market so this recent underperformance would be a difficult issue, there were already questions whether it would be able to maintain its equity market accessibility.

As well as the political problems, the firm said ‘debt re-profiling and imposition of capital controls added to market concerns’ in Argentina.

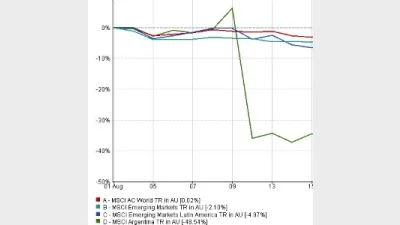

During August, the MSCI Emerging Markets Latin America index lost 4.9% while the wider MSCI Emerging Markets index lost 2%, according to FE Analytics. The MSCI AC World index, which includes developed markets, was flat with returns of 0.02%.

However, the problems seemed largely contained within Argentina with Mexico being an outperformer with returns of 3.7% over the same period. It was also likely to benefit from the US/China trade war as it was a cheap place for manufacturing if companies were seeking an alternative to China.

“While we expect the volatility in financial markets to continue in the interim amid uncertainty about policies the newly elected administration will pursue, we believe the financials and consumer discretionary sectors remain attractive. Valuations have fallen to attractive levels, while profitability remains high,” said Franklin Templeton.

“Separately, the country’s favourable demographics, which includes a young working population, also helps support consumerism. Moreover, Mexico has done quite well in positioning itself as a manufacturing hub for the United States.”

Latin America suffered during August, underperforming against its global and emerging market peers, with Argentina losing more than 48% during the month.

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.