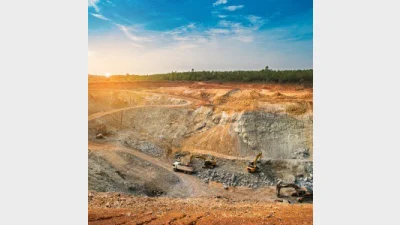

Demand for Australian iron ore boosts resources stocks

The supply constraints caused by COVID-19 restrictions on trade with China have shifted demand for Australian iron, benefitting companies like BHP, Rio Tinto and Fortescue Metals.

According to Ausbil, the resources sector was a beneficiary of the ongoing geopolitical tensions as well as increased infrastructure spending.

Demand from China for Australian iron ore and coal was at record levels despite the trade tensions between the two countries as it was a necessary part of China’s infrastructure stimulus. In the first half of 2020, iron ore imports to China rose by 10% and Australia accounted for up to 60% of China’s annual iron ore imports.

This was despite China imposing tariffs on Australian imports such as barley and education earlier this year.

Shares in Fortescue Metals, which deals solely in iron ore, had risen 62% since the start of 2020 to 15 July.

Ausbil chief investment officer Paul Xiradis said: “On the basis of fiscal stimulus and accelerated infrastructure spending, the outlook for resources and particularly steelmaking resources is pretty strong. Iron ore, the most important of these for Australia in terms of trade, is seeing renewed demand as COVID-19 driven supply constraints shift demand to Australian iron ore”.

BHP and Rio Tinto were top 10 positions in six of the firm’s Australian equity funds with the Active Dividend Income Wholesale fund also holding 2.6% in Fortescue Metals.

Ausbil had also initiated a new position in Oz Minerals in light of increased usage of electric vehicles which would mean increased demand for copper.

“During the shutdown, traditional car manufacturers were retooling towards the production of electric vehicles, creating further demand for selective metals. The changing trend towards electric vehicles will see increased demand for copper from companies like Oz Minerals, as well as nickel and lithium in the next 12 months.”

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.