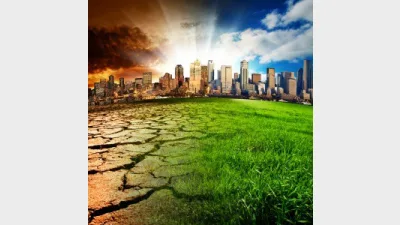

Climate change a key financial risk

Climate change and the financial risk it entails has become the “largest consideration” for many advisers and investors as they increasingly think about ethical investing, according to BetaShares.

Speaking at a media briefing in Sydney yesterday, BetaShares managing director, Alex Vynokur said the financial risk inherent in climate change was driving demand for ethical investment solutions.

“If you consider the push from consumers to support ethical companies, it’s not surprising this flows through to the bottom line, driving superior performance and better equity market returns,” Vynokur said.

“The natural sector bias of ethical indices has also sheltered the sector from the downturn associated with the end of the resources boom.”

The demand for ethical investing was driven by institutional investors, and particularly younger investors of exchange traded funds (ETFs) who were enthusiastic about exploring sustainable investment options that not only provided returns but had a positive social and environmental impact.

“We found that a lot of younger investors in exchange traded funds actually care about the cause. For them it’s about a lot more than just an investment. They want to be connected to the investment. They want to relate to the cause. They want the investment dollars to make an impact on society,” Vynokur said.

BetaShares’ joint research with Investment Trends showed the next wave of ETF investors in Australia were people who were 10 to 20 years younger than the early adopters of ETFs.

Asset Owners Disclosure Project’s chairman, Dr John Hewson, who also spoke at the media briefing, said the Australian Prudential Regulation Authority (APRA) had also begun warning investors that climate change could threaten the entire financial system, which was encouraging institutional investors to reassess climate change risk in their asset allocations.

“The key issue for them is that their trustees and directors actually have a fiduciary responsibility as a superannuation to manage those investments over the lifetime… the working life of the member to maximise their returns,” he said.

“Once it is established that there is a direct, personal financial responsibility as a director of those funds for those investments you will get a completely different attitude and I think that’s just around the corner.”

Vynokur acknowledged, however, that the challenge remained to contest traditional wisdom that investors must forego healthy investment returns when opting for sustainable investment, which was considered a “feel good” investment.

“Even though we’re not necessarily talking to investors about the fact that you should always expect to outperform with a sustainable portfolio but certainly there is no case for people to be concerned about underperformance,” he said.

Recommended for you

Schroders has appointed a new chief executive as Simon Doyle steps down from the asset manager after 22 years.

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.