China still best in Asia: Fidelity

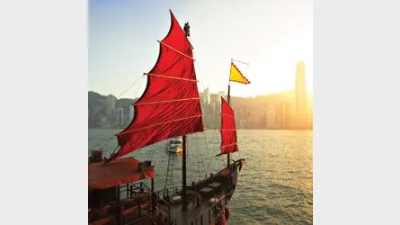

Although interest in Chinese equities has waned, investors underestimate the policy flexibility available to the Chinese Government and the region still represents the best investment opportunity in Asia, according to Fidelity Worldwide Investment (Hong Kong) investment director Catherine Yeung.

Although earnings guidance has pretty much stabilised, there is still expected earnings growth in China of around 12 to 15 per cent, which is still very attractive, Yeung said.

Equity valuations were still attractive in Asia overall with cheap price-to-earnings ratios, and although it could be argued the same was true of Europe, the dividend returns were more attractive in Asia than in the developed world, Yeung said.

She said that although investors might question why China seemed to have left it so late to act in terms of policy settings, there were many other levers besides interest rates available to the Chinese Government.

Earlier this year, for example, the Government issued a list of 400 models of car available to the people who procure cars on behalf of government officials - and all 400 models were Chinese.

"So they can just use all these different levers without touching interest rates," Yeung said.

"People really have underestimated some of the policy flexibility they have."

It was still important to be diversified across Asia, Yeung said, because there were many interesting opportunities in places such as Thailand - although it was expensive right now - as well as Korea. Although it was not a risk-free asset, "if you could say you could only put your money in one Asian market this year, and I know it hasn't worked yet, I would still say China," Yeung said.

Recommended for you

Schroders has appointed a new chief executive as Simon Doyle steps down from the asset manager after 22 years.

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.