BHP Billiton reports 39% profit increase

Mining giant BHP Billiton, one of Australia’s largest miners, has reported a 39% profit increase but cautioned coronavirus could lead it to revise its expectations downwards for the year ahead if it is unresolved by the end of March.

In its results, the firm said underlying profit rose by 39% from US$3.7 billion to $5.1 billion in the six months to 31 December, 2019.

This was the first results for new chief executive Mike Henry who took over from Andrew Mackenzie in January.

The company is a stalwart in many Australian equity funds such as Plato Australian Shares Income, EQT Flagship, Pendal Australian Equity and Bennelong Australian Equities.

BHP is an 8.4% weighting in EQT Flagship and Plato Australian Shares Income, 7.7% in Bennelong Australian Equities and 6.2% in Pendal Australian Equity.

It declared its highest first-half dividend on record of 65 US cents per share. This, it said, was a reflection of the ‘solid cashflow generated in the period, caution due to near term market volatility driven by the 2019 coronavirus outbreak’ among other factors.

But going forward, the miner said it would likely revise its expectations for commodity growth downwards if the coronavirus remained uncontained.

“If the viral outbreak is not demonstrably well contained within the March quarter, we expect to revise our expectations for economic and commodity demand growth downwards.

“We highlight the distinction between a permanent loss of demand in oil due to foregone transport services; and temporary demand losses with the opportunity to be reclaimed, as in steel and copper end-use.”

Regarding the summer’s bushfires, it said costs at the firm’s New South Wales division had increased during the period as a result of the operational impact of reduced air quality from bushfire smoke and dust.

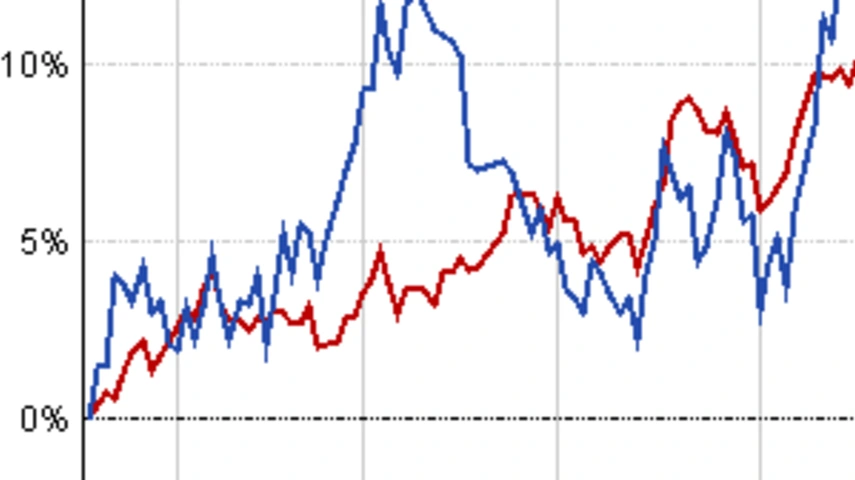

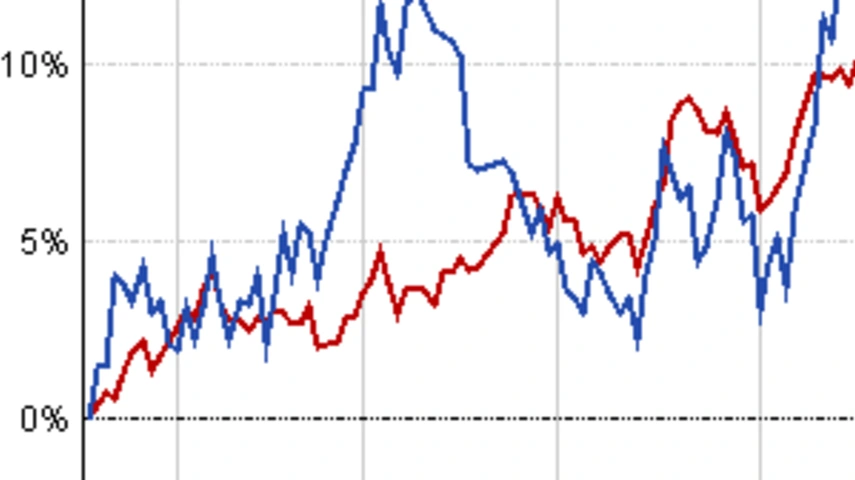

Shares in the miner rose 11% over the 12 months to 17 February, 2020 versus returns of 22% by the ASX 200 over the same period.

Performance of the BHP Billiton share price over 12 months to 17 February, 2020 versus ASX 200

Recommended for you

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.

Philanthropic investment group Future Generation’s CEO, Caroline Gurney, will step down from her role at the start of next year.

The newly combined L1 Group is expectant of stabilising Platinum’s falling funds under management within the next 18 months, unveiling four growth pathways and a $330 million equity raise.

Janus Henderson Investors has launched a global small-cap fund for Australian investors, which includes a 5.4 per cent weighting to Australian equities.