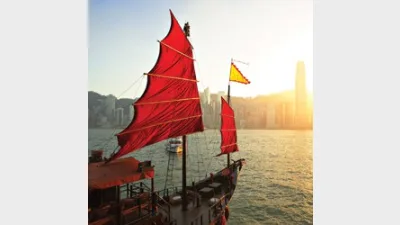

Asian Region Passport gets tick of approval

Four countries, including Australia, signed a pledge last week to simplify funds transfers between Asia and Pacific nations.

Australia, South Korea, New Zealand and Singapore elected to go ahead with the Asian Region Funds Passport — a plan which would allow Asian investors direct access to Australian products — after four years of deliberations.

The pilot project is scheduled to launch in 2016.

Financial Services Council CEO John Brogden said the agreement had the potential to make financial services Australia's next major export industry and he hoped other economies got on board.

"This landmark agreement will mean Australia's fund managers will be able to access cross-border investment opportunities within Asia for the first time and take advantage of the strong demand for financial services in the region," he said.

"We expect the next six to 12 months will involve extensive consultation with the industry and regulatory bodies from the participating nations."

Recommended for you

Natixis Investment Managers has hired a distribution director to specifically focus on the firm’s work with research firms and consultants.

The use of total portfolio approaches by asset allocators is putting pressure on fund managers with outperformance being “no longer sufficient” when it comes to fund development.

With evergreen funds being used by financial advisers for their liquidity benefits, Harbourvest is forecasting they are set to grow by around 20 per cent a year to surpass US$1 trillion by 2029.

Total monthly ETF inflows declined by 28 per cent from highs in November with Vanguard’s $21bn Australian Shares ETF faring worst in outflows.