AMP Capital buys West Australian prison

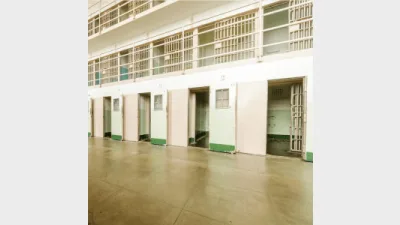

AMP Capital has purchased a Kalgoorlie-based regional prison redevelopment project as part of its community infrastructure fund (CommIF).

The fund manager purchased the West Australian prison in public private partnership (PPP) with the Western Australian state government, from Lend Lease and MLC.

AMP Capital Community Infrastructure fund manager, Andrea McElhinney, said the project provided long-term highly predictable cash flows, underpinned by the West Australian government.

It had an attractive risk and return profile which fit perfectly with CommIF's investment mandate and allowed the fund to expand to Western Australia, which provided investors with further diversification, she said.

The project involved constructing a new 350-bed prison and demolishing the existing 100-bed facility.

The enterprise period was estimated to be a total of 28 years, which included construction time, plus 25 years, AMP Capital said.

The CommIF fund currently invested in 13 social infrastructure assets in Australia and New Zealand, worth a total $8.2 billion. Those assets included primary, secondary and tertiary education institutions, as well as assets in health, justice, defence, water, and community services.

Recommended for you

Schroders has appointed a new chief executive as Simon Doyle steps down from the asset manager after 22 years.

Distribution of private credit funds through advised channels to retail investors will be an ASIC priority for 2026 as it releases the results of its thematic fund surveillance and guidance for research houses.

State Street Investment Management has taken a minority stake in private market secondaries manager Coller Capital with the pair set to collaborate on broaden each firm’s reach and drive innovation.

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.