Synchron heartened by FSI vertical integration scrutiny

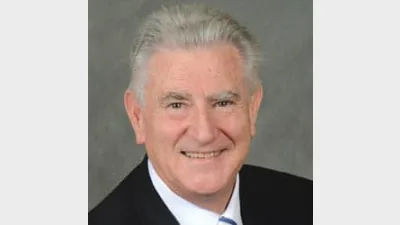

The Financial System Inquiry’s (FSI’s) call for clarity on potential vertical integration conflicts could see moves towards parent-company transparency in the aligned advice space, Synchron director Don Trapnell hopes.

A vocal advocate of vertical integration exposure, Trapnell said the interim report’s acknowledgement of vertical integration and calls for submissions is heartening, given the lack of awareness about the relationship between advisers and the products they endorse from many consumers.

Trapnell believes institutionally-aligned advisers should be declare their links to their parent organisation, so that the consumer can make an informed decision about the product the adviser puts forward.

“As we have always said, it is in the best interests of consumers to ensure that they are fully aware of all the relationships that exist between their advisers and the products their advisers recommend, and how those relationships have the potential to impact on the advice they are given,” he said.

“In fact, we believe it is essential, given the adviser’s obligations under the Best Interests Duty provisions of the Future of Financial Advice legislation.”

Recommended for you

Compared to four years ago when the divide between boutique and large licensees were largely equal, adviser movements have seen this trend shift in light of new licensees commencing.

As ongoing market uncertainty sees advisers look beyond traditional equity exposure, Fidante has found adviser interest in small caps and emerging markets for portfolio returns has almost doubled since April.

CoreData has shared the top areas of demand for cryptocurrency advice but finds investors are seeking advisers who actively invest in the asset themselves.

With regulators ‘raising the bar’ on retirement planning, Lonsec Research and Ratings has urged advisers to place greater focus on sequencing and longevity risk as they navigate clients through the shifting landscape.