Qld adviser permanently banned

A former Millennium 3 Financial Services representative and employee of Lifestyle Financial Services, Neil Bruce has been permanently banned from providing financial advice after the corporate regulator found he had not issued some clients with statements of advice (SOA).

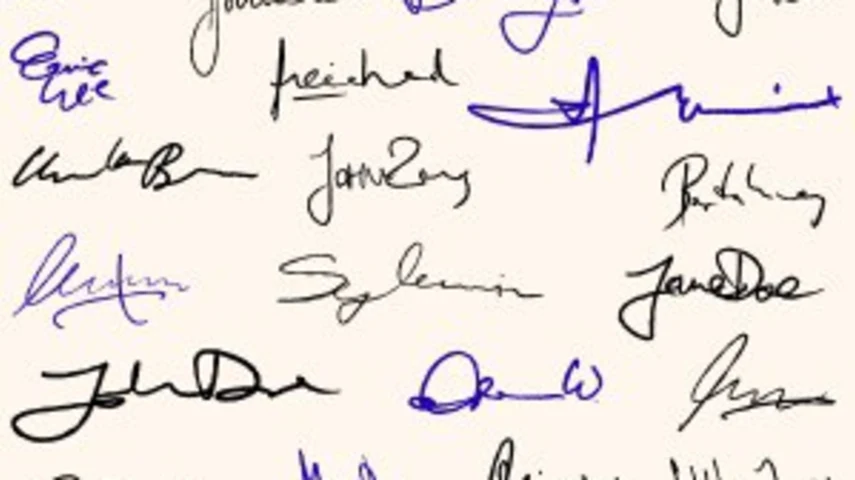

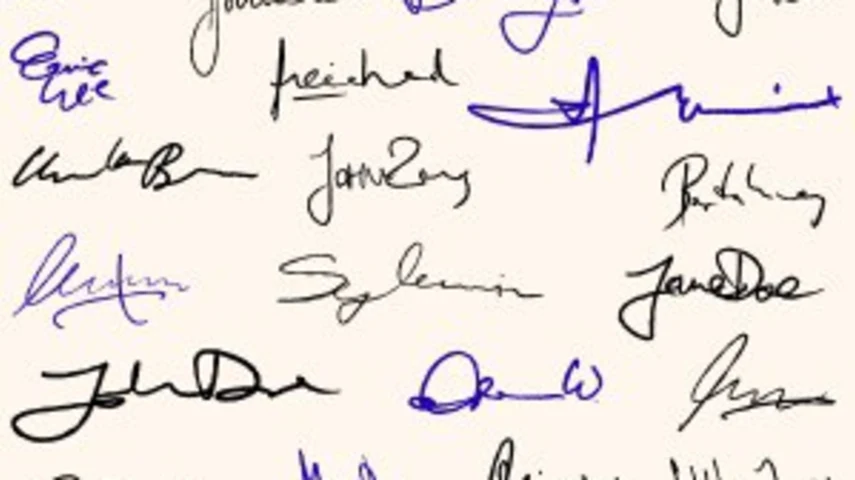

The Australian Securities and Investments Commission (ASIC) found that the Brisbane adviser had failed to provide clients with SOAs while holding an Australian financial services license and applied the signatures of a number of clients to internal and external documents in order to pass an internal compliance audit.

ASIC deputy chair, Peter Kell, said: “Certain compliance requirements are in place for advisers to ensure they are meeting their obligations to clients, and to ensure they act honestly and with integrity”.

“Anyone whose conduct falls short of these standards will be removed from the financial services industry,” he said.

The internal audit team at Millennium 3 Financial Services reported Bruce to ASIC after the signature irregularities were identified in the audit.

Millennium 3 Financial Services is owned by ANZ.

Recommended for you

Unregistered managed investment scheme operator Chris Marco has been sentenced after being found guilty of 43 fraud charges, receiving the highest sentence imposed by an Australian court regarding an ASIC criminal investigation.

ASIC has cancelled the AFSL of Sydney-based Arrumar Private after it failed to comply with the conditions of its licence.

Two investment advisory research houses have announced a merger to form a combined entity under the name Delta Portfolios.

The top five licensees are demonstrating a “strong recovery” from losses in the first half of the year, and the gap is narrowing between their respective adviser numbers.