Conflicts of interests should be clear as mud

Financial services licensees should make it a point to highlight their conflicts of interests with life insurance companies to clients.

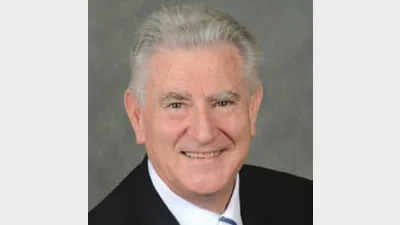

There needs to be legislation or regulation passed that requires Australian financial services licensees (AFSL) to clearly show any conflicts of interests with insurance companies, according to Synchron director Don Trapnell.

Trapnell believes that while a recommendation for an insurance company's product might not necessarily be a bad recommendation, the client has a right to know.

He also laments that companies do not make it clear enough in their paperwork, financial services guide, or statement of advice that they are owned by a life insurance company.

"If I was an authorised representative of a licensee and the company that owned me is a particular life company, and he owned my licensee, and I recommended that company's product, my clients have every right to know that I am recommending a product of my owner," he said.

"That's not just a matter of mentioning it; it should be made a point of being mentioned."

He also refutes the theory that the vertical integration model will be handled because of its best interests' duty.

"What a lot of rubbish. When you have a licensee telling its authorised representatives that 40 per cent of the risk product they sell has to be placed with the parent company, do you think best interest duty will protect the client in that regard?

"That's why I'm saying the vertical integration model is flawed," he said.

Recommended for you

ASIC has released the results of the latest financial adviser exam, held in November 2025.

Winners have been announced for this year's ifa Excellence Awards, hosted by Money Management's sister brand ifa.

Adviser exits have reported their biggest loss since June this week, according to Padua Wealth Data, kicking off what is set to be a difficult December for the industry.

Financial advisers often find themselves taking on the dual role of adviser and business owner but a managing director has suggested this leads only to subpar outcomes.