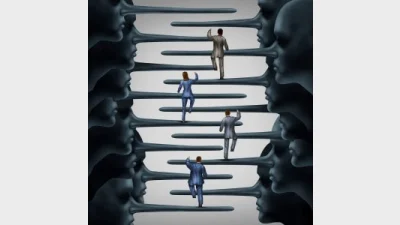

ASIC cracks down on debt firms’ false advertising

The Australian Securities and Investments Commission (ASIC) has issued an infringement notice to a debt resolution firm and ordered two others to remove misleading advertising as part of its crackdown on false advertising by debt resolution firms.

Capital Debt Solutions Australia Pty Ltd has been issued a $10,800 infringement notice, while Debt Assist Aust Pty Ltd and Bankruptcy Experts Pty Ltd have removed misleading statements online.

ASIC raised concerns that Capital Debt Solutions had false claims on its website stating the firm was trusted and recommended by over 6,000 Australians. ASIC said there was no evidence for the figure and deemed the advertising misleading.

The firm and Debt Assist Aust have also removed false online statements after ASIC found their debt agreements were not “government approved”.

The regulator also found debt solutions firm, Bankruptcy Experts had testimonials on its website that were unable to be substantiated.

ASIC deputy chairman, Peter Kell, said misleading advertising was damaging for consumers.

“'Firms must ensure their marketing materials and promotional statements are based on fact,” he said.

“Recommendations and statements, like 'government approved' can have a strong influence when vulnerable consumers in financial hardship are seeking help with their debts.”

Recommended for you

Melbourne advice firm Hewison Private Wealth has marked four decades of service after making its start in 1985 as a “truly independent advice business” in a largely product-led market.

HLB Mann Judd Perth has announced its acquisition of a WA business advisory firm, growing its presence in the region, along with 10 appointments across the firm’s national network.

Unregistered managed investment scheme operator Chris Marco has been sentenced after being found guilty of 43 fraud charges, receiving the highest sentence imposed by an Australian court regarding an ASIC criminal investigation.

ASIC has cancelled the AFSL of Sydney-based Arrumar Private after it failed to comply with the conditions of its licence.