Market Insights

Vietnam is an exciting - and underappreciated – emerging markets investment opportunity, with an economic transformation reminiscent of China and driven by export growth,...

What's driving the shift in the Asian supply chain dynamic, and which countries are positioned to benefit from the changes? Ox Capital Management’s Dr Joseph Lai unpacks ...

Currency risk is very real and can be costly for many businesses dealing in foreign currencies. Find out what banking methods to use to decrease this risk for your busine...

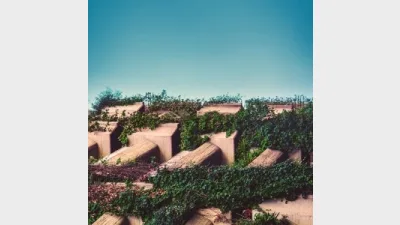

Investors with an ESG focus can take a lot from leading and technologically resourceful real estate companies in the world’s largest office market as they move quickly on...

To meet the world’s net zero targets, new technologies will be needed to rapidly reduce emissions and carbon capture, utilisation and storage is one solution gaining sign...

Multiple structural shifts are underway across the built environment as it undergoes rapid transformation to reduce its carbon intensity....

Pricing power has never been as important for investors with inflation on the rise. Find out which companies we believe are best placed to keep rewarding investors....

In an urgent bid to address the agriculture sector’s carbon footprint, while balancing the needs of feeding the global population, a wave of innovative solutions and tech...

Volatile markets pose unique challenges and questions from investors. We open up the conversation with our retirement experts and advisers. Watch now....

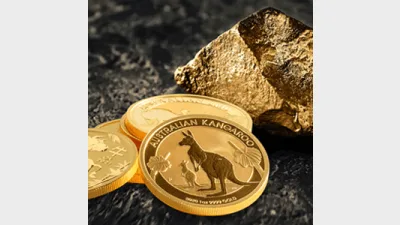

It could be the ideal time for financial advisors to change their stance on gold and recommend it as a worthwhile investment when thinking strategically about diversifyin...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...