KERRY CRAIG

A recession in the US is likely next year, according to JPMAM’s Kerry Craig, but could work positively, akin to a forest fire, by clearing out excess in markets....

Looking at the performance of risk assets following the 1970s ‘Great Inflation’ can soothe investors’ angst as inflation and interest rates begin to rise, according to J....

While markets are tense and volatile, writes Kerry Craig, the one thing the last few months has made clear is that alternative assets are an essential part of any asset a...

With the US Federal Reserve increasing its policy rate by 25 basis points to 0.50%, fund managers and economists have weighed in on the impact for Australian investors....

With inflation rising, global central banks are being forced to rethink their monetary policy actions and are likely to begin tapering soon, writes Kerry Craig....

Government debt accumulated during the COVID-19 pandemic will set a precedent for the next economic cycle, Kerry Craig, writes....

Without the wide distribution of COVID vaccines, the virus and the economy will remain locked together and investors should get ready for a bumpy start of the new economi...

Over the next decade there will a depreciation of the US dollar and this will give more support to Asian asset returns over time, according to J.P. Morgan Asset Managemen...

Kerry Craig explores how AID – alpha, income and diversification – can help advisers with construction of their clients’ investment portfolios....

J.P. Morgan Asset Management has struck a positive outlook on Australia’s recovery from the COVID-19 pandemic, saying a second wave could defer current growth paths but w...

Central banks are using unprecedented levels of stimulus to support the economy, writes Kerry Craig, leaving investors with expensive bond prices and record low interest ...

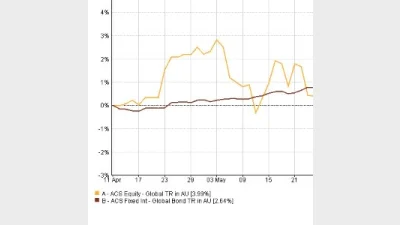

Now is the time for investors to review their portfolios and consider a greater degree of diversification such as alternatives for income and growth, according to J.P. Mo...

Managers have praised the Reserve Bank of Australia’s efforts but warned the central bank can ‘only do so much’ to stop the tide of the worldwide economic chaos caused by...

The prospect of central banks globally cutting rates – as our own Reserve Bank has done twice already – has seen equities stocks rise and bond yields do the reverse, rais...

The forward guidance delivered by the Fed yesterday “was no longer about being patient but being pragmatic,” according to JP Morgan Asset Management’s Kerry Craig, with y...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...