GLOBAL FINANCIAL CRISIS

Investor pessimism is close to a 20-year low thanks to the global banking crisis and in line with sentiment during the Global Financial Crisis, a notable reversal of Febr...

While markets are tense and volatile, writes Kerry Craig, the one thing the last few months has made clear is that alternative assets are an essential part of any asset a...

Natixis Investment Managers has reduced its exposure to equities in light of coronavirus in expectation of higher volatility in stockmarkets....

Investing in global equities can protect investors from a weaker Australian dollar, according to Plato Investment Management....

Australian Leaders Fund looks to discount its NTA as it prepares for the end of the longest business cycle....

The global economy is less resilient than 12 years ago at the onset of the financial crisis with the Euro area having seen the biggest decrease in resilience over the per...

More unintended consequences appear to have emerged from the Government’s changes to insurance inside superannuation, with superannuation funds reporting an uptick in cla...

The Australian Securities and Investments Commission has estimated that remediation provisioning by Australia’s major financial institutions has so far reached $9 billion...

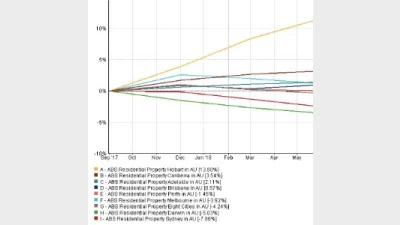

The weakening in the Australian economy has been triggered by a protracted downturn in the housing market, according to Fitch Ratings....

April’s end marked the 19th consecutive month of house price declines since they peaked in September 2017, with one economist predicting that the downturn won’t end until...

Value investing comeback is near, according to a new white paper from Perennial Value Management....

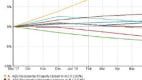

Nine years into the global market’s bull run, ETFs appear to be pushing US tech stocks into unrealistic valuations in ways that may end badly for many, a new whitepaper s...

After approaching near-record highs in FY2016, voluntary superannuation contributions eased slightly in FY2017 to an average of $1,054, according to SuperRatings....

BT Panorama has added the ARCO Absolute Return Fund to the platform, providing more advisers and clients with access to the manager’s 10-year track record....

A decade on from the fall of Lehman Brothers, Jeffrey Kleintop looks at what market shocks and vulnerabilities have the potential to spark another financial crisis should...

The succession dilemma is more than just a matter of commitments.This isn’t simply about younger vs. older advisers. It’...

Significant ethical issues there. If a relationship is in the process of breaking down then both parties are likely to b...

It's not licensees not putting them on, it's small businesses (that are licensed) that cannot afford to put them on. The...