Super funds ripe for picking – Bouris

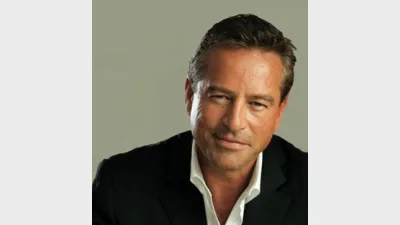

The superannuation industry is ripe for the picking by industry disruptors, according to the chairman of Yellow Brick Road, Mark Bouris.

Addressing the Association of Superannuation Funds of Australia (ASFA) conference in Melbourne, Bouris warned fund trustees and executives that the needed to be alert to the capacity for other parties to steal their relationship with their members.

In doing so, he said that he should not be interpreted as threatening superannuation funds but, rather, warning them of what could happen if they did not remain alert to the threat posed by companies capable of disruption.

Bouris said those companies could be distinguished by the reality that they were small and nimble, dynamic and entrepreneurial with no legacy issues and a capacity to succeed without actually gaining large market share.

“This risk is someone getting between and your members and having a relationship with them,” he said.

While claiming not to be a threat, Bouris said that Yellow Brick Road had developed a presence in terms of providing advice with respect to superannuation and said the company would be looking to pursue its interests by seeking a super provider “who is going to look after us”.

However he said that while superannuation funds might find themselves the target of industry disruptors, they had the capacity to also be disruptors via the adopting of new approaches and new technology.

Recommended for you

ASIC has commenced civil penalty proceedings in the Federal Court against superannuation trustee Diversa Trustees, regarding the First Guardian Master Fund.

The winners have been announced for the 2025 Super Fund of the Year Awards, held in Melbourne on 26 November by Money Management's sister brand Super Review.

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.