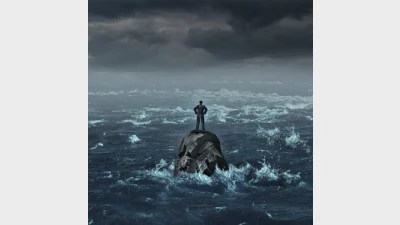

Super fund mergers a tax ‘perfect storm’

Rationalising equity fund managers and strategies in merged superannuation entities may create inefficiencies and heighten tax transaction costs which will ultimately affect members, according to Parametric.

Commenting on the potential merger of more of Australia’s superannuation funds, Parametric managing director of research, Raewyn Williams said customer urgency for super fund disciplines that deliver transparency and efficiency was high in the current environment.

“Super fund mergers create a need for a legacy-to-target portfolios pathway. The pathway is far from frictionless and these frictions are real costs to fund members,” she said.

“The combination of merger-driven portfolio rationalisation, strong equity performance with embedded gains and a pre-tax investment and transition focus could create something of a ‘perfect storm.’”

Williams said the predicted consolidation activity could cost super fund members in the long run, as implementation inefficiency was at its most probable throughout that period.

“Most equity fund managers offer suer funds very little transparency around what they pay in brokerage and foreign exchange commissions. Add to this no visibility as to tax costs,” she said.

“The fact that these portfolios are typically spread across a number of fund manager sleeves makes it even harder.”

Better consideration for how funds speculating a merger would manage the taxed transaction costs of multiple managers and strategies within a potential combined business was also touted as vital.

“In a change environment like a super fund merger, the stakes will logically be much higher,” Williams concluded.

Recommended for you

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.

SuperRatings has shared the median estimated return for balanced superannuation funds for the calendar year 2024, finding the year achieved “strong and consistent positive” returns.