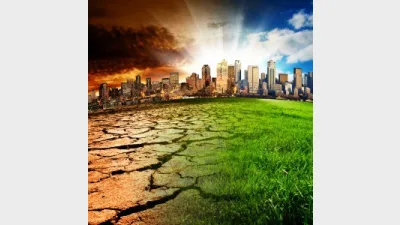

Loans need to be consistent with climate change

Lending companies need to go further and call out projects that are inconsistent with a two degree climate warming limit, Australian Ethical believes.

Responding to the Federal Government's consideration of a $1.1 billion loan for the Adani Carmichael coal project, the superannuation fund said achieving success for the planet required cooperation between the political sphere, business, and investment markets.

Australian Ethical managing director, Phil Vernon, pointed to Westpac's recent commitment to ensure its loans were consistent with limiting warming to below two degrees but noted that the bank refused to rule out support for the Adani Carmichael mine.

"Numerous other banks have ruled out financing this new mine project on sustainability grounds. We expect Westpac's actions to align with its climate policy — we need confidence that lending to Adani is inconsistent with Westpac's climate commitments," he said.

"…but leading companies need to go further and call out projects which are clearly inconsistent with a two degree warming limit. Only in this way will we catalyse government and private sector action to direct capital in a way which limits warming."

Vernon said businesses needed to make decisions based on more than just concerns about the political risk of increased climate regulations as it was the right thing to do.

"Investors can also push for change in the companies they support, especially in the $1.7 trillion superannuation sector, where funds have the potential to positively influence boards and management to better manage their social and environmental impacts," Vernon said.

Recommended for you

Data and technology provider Novigi has acquired Iress’ superannuation consulting and managed services business from Apex Group.

AMP is to launch a digital advice service to provide retirement advice to members of its AMP Super Fund, in partnership with Bravura Solutions.

Unveiling its performance for the calendar year 2024, AMP has noted a “careful” investment in bitcoin futures proved beneficial for its superannuation members.

SuperRatings has shared the median estimated return for balanced superannuation funds for the calendar year 2024, finding the year achieved “strong and consistent positive” returns.