Zenith adds Legg Mason’s fund to its portfolio

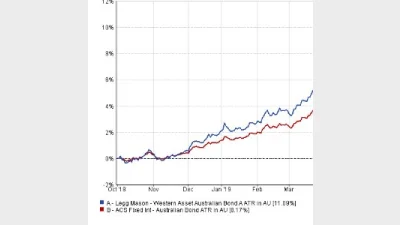

The Legg Mason Western Asset Australian Bond Fund, with more than $1 billion in funds under management, has been added to the Zenith Investment Partners’ Elite Blend portfolios.

Zenith’s managing partner and joint founder, David Wright, said that the fund was Zenith’s preferred Australian Fixed Income strategy, due to its approach that emphasised team-based decision making and intensive proprietary research supported by risk management.

“We place this fund in the ‘highly recommended’ rating category. We believe it is well-positioned to generate returns through a range of active strategies including sector rotation, credit selection and, to a lesser extent, interest-rate and yield-curve positioning,” he said.

“The fund is considered appropriate for those seeking exposure to domestic fixed interest and for blending with international fixed interest strategies to produce a more balanced set of investment outcomes.”

The fund, managed by Anthony Kirkham, was also considered to be among the strongest propositions within Zenith’s rated Australian Fixed Income ‘Bonds’ peer group’.

“We are proud to partner with the Zenith Consulting team who have recognised the strong investment capabilities of Western Asset alongside the diversification and defensive characteristics that this Fund brings to a portfolio, especially in today’s volatile market conditions,” Andy Sowerby, managing director, Legg Mason Australia and New Zealand, said.

The fund recently surpassed $1 billion in funds under management and was also available as an Active ETF which debuted on the Australian Securities Exchange (ASX) in November last year.

Recommended for you

The newly combined L1 Group is expectant of stabilising Platinum’s falling funds under management within the next 18 months, unveiling four growth pathways and a $330 million equity raise.

Janus Henderson Investors has launched a global small-cap fund for Australian investors, which includes a 5.4 per cent weighting to Australian equities.

The CEO of L1 Group, formerly known as Platinum Asset Management, has stepped down with immediate effect, and the asset manager has announced his replacement.

Private equity manager Scarcity Partners has backed a specialist investment manager focused on metals and mining, seeking to meet investor demand for real assets.