Why CommBank remains a stand-out share

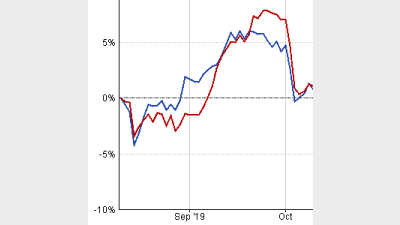

As two major banks announced their financial results this week, it’s a tale of two diverging share prices for Commonwealth Bank and National Australia Bank.

In the last six months to 13 February, Commonwealth Bank’s share price rose 13.6% while its rival NAB lost 3% over the same period.

Over a year to the same date, Commonwealth Bank rose 27.3% while NAB reported an increase of 15%.

NAB’s sharp downward trend began in November 2019 and was caused by the firm announcing it had experienced a 10.8% reduction on its cash earnings as a result of customer remediation and changes to its software.

In its first-half results this week, the firm announced a 1% increase in cash earnings but said it had pushed back the sale of its MLC Wealth business until after the current financial year as the business environment remained ‘challenging’.

While it remained trading at a far lower share price than Commonwealth Bank, the firm was managing to reverse the downward trend and its share price was up 6% since the start of 2020.

Meanwhile Commonwealth Bank beat expectations with its first-half results with $4.48 billion in cash profit, versus analyst expectations of $4.34 billion, although this was down 4.3% on last year’s figures.

The summer’s bushfires and drought resulted in $83 million of insurance claims provisions and chief executive Matt Comyn said these factors plus the coronavirus would likely “weigh on sentiment” in this quarter and the next one.

Share price performance of CommBank v NAB over six months to 12 February, 2020

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.