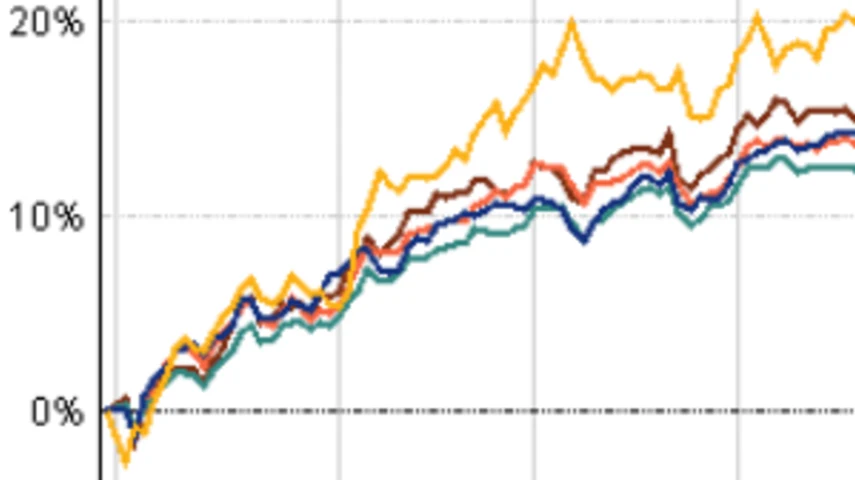

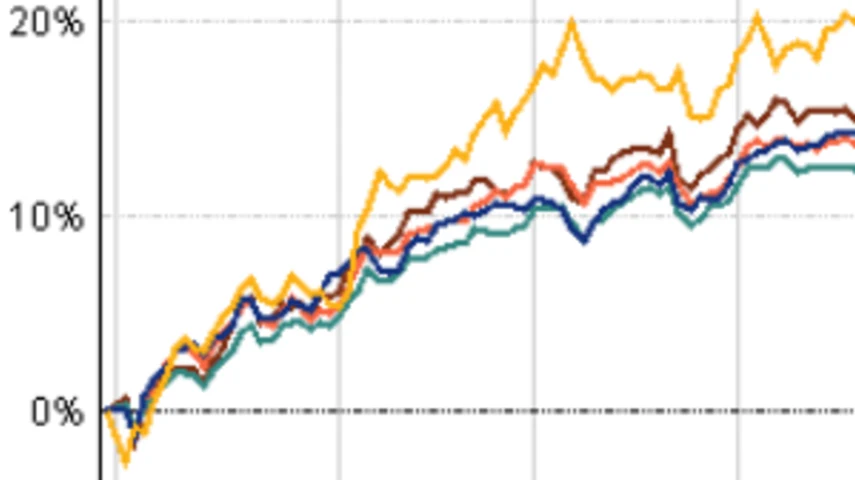

What was the best performing equity sector for 2019?

The best performing sector in 2019 was Australian geared equities, which returned 36.43%, according to data from FE Analytics.

Within the Australian Core Strategies Universe, this was followed by North American equities (31.27%), global equities (25.03%), global hedged equities (24.91%), and specialist equities (24.79%).

The Australian geared sector had the highest volatility of the five (15.38), followed by North America (12.01) – both the highest of all equity sectors.

In the Australia geared sector, the best performers were BetaShares Geared Australian Equity Hedge (57.78%), CFS Colonial First State Wholesale Geared Share (56.95%), Ausbil Australian Geared Equity (52.52%), CFS Acadian Wholesale Geared Australian Equity (50%) and OnePath

Wholesale Geared Australian Shares Index Trust B (45.04%).

In the North America sector, the leaders were BetaShares Geared US Equity Currency Hedged (69.01%), BetaShares NASDAQ 100 ETF (38.77%), VanEck Vectors Morningstar Wide Moat ETF (34.89%), Pendal American Share (32.75%), UBS IQ MSCI USA Ethical ETF (31.38%).

The global hedged sector best performers were Evans And Partners International Hedged B (39.62%), Zurich Investments Hedged Concentrated Global Growth (38.78%), Zurich Investments Hedged Global Growth Share (33.9%), Zurich Investments Hedged Global Thematic Share (29.47%) and Vanguard Ethically Conscious International Shares Index Hedged NZD (28.97%).

Top five best performing equity sectors over the year to 31 December 2019

Recommended for you

Blackwattle Investment Partners has hired a management trio from First Sentier Investors – who departed amid the closure of four investment teams last year – to run its first equity income offering.

Private markets manager Fortitude Investment Partners has launched an evergreen small-cap private equity fund.

After passing $300 billion in funds under management, Betashares is forecasting the Australian ETF industry could reach $500 billion by the end of 2028.

Ausbil is to expand its active ETF range with two ASX-listed launches, one focusing on global small caps and one on listed infrastructure.