Were you invested in these top Aussie equity funds in 2019?

Despite 2019 having no absence of domestic and international political unrest, the Australian equity sector still managed to return 22.56%, according to FE Analytics.

The best two performing Australian equity funds in 2019 within the Australian Core Strategies universe were both from DDH, with their Selector Australian Equities fund leading the way with a return of 39.21%.

Rounding out the top 10 was DDH Selector High Conviction Equity A (35.32%), Hyperion Australian Growth Companies (34.04%), Clime Australian Equities (31.97%), IOOF MultiMix Australian Equities (31.97%), IOOF Specialist Australian Shares (31.87%), UCA Australian Equities Trust Wholesale (31.52%), Crescent Wealth Australian Equity Retail (30.71%), UBS HALO Australian Share (29.55%) and Clime Australian Value Wholesale (29.44%).

The top holdings for the DDH Selector Australian Equities fund were Aristocrat Leisure (4.88%), James Hardie Industries (4.81%), IOOF (4.74%), IRESS (4.72%) and Jumbo Interactive (4.49%), as of 30 November, 2019.

Their sector weightings were in consumer products (29.8%); telecom, media and technology (19.78%); healthcare (18.13%); financials (10.17%); basic materials (8.71%); industrials (8.6%); and money market (4.82%).

For the High Conviction Equity A fund, the top holdings were Aristocrat Leisure (6.2%), James Hardie Industries (5.28%), Altium (5.04%), Seek (5%) and ResMed (4.79%).

Hyperion’s top holdings were Cochlear (10.23%), REA Group (10.22%), CSL (10.05%), Domino’s Pizza (8.74%) and Macquarie Group (7.03%), as of 30 November, 2019.

Their sector weightings were healthcare (31.6%), information technology (17.1%), communication services (12.5%), consumer discretionary (11.1%), financials (11%), cash (9.1%) and industrials (7.6%).

Clime’s Australian Equities fund top holdings were BHP (6.1%), Amcor (5.3%), Webjet (4%), Westpac (3.7%) and Bravura (3.5%).

Their asset allocations were in large cap equities (33.3%), mid-cap equities (30.3%), small-cap equities (25.5%) and cash (10.9%).

IOOF’s multimix top holdings were Avita Medical (4.66%), Commonwealth Bank (3.44%), BHP (2.98%), NAB (2.73%) and Westpac (2.57%), as of 30 September, 2019.

Their biggest sector weightings were financials (26.27%); basic materials (19.31%); consumer products (16.36%); heath care (14.37%); and telecom, media and technology (10.78).

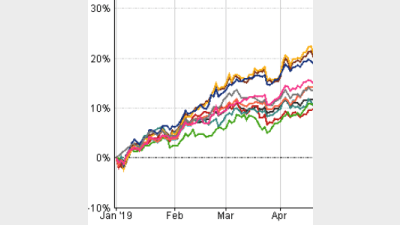

The top 10 performing Australian equity funds in 2019

Recommended for you

BlackRock Australia plans to launch a Bitcoin ETF later this month, wrapping the firm’s US-listed version which is US$85 billion in size.

Financial advisers have expressed concern about the impact including private market exposure is having on their tracking error budget, according to MSCI.

State Street will restrict its membership of global climate alliance Net Zero Asset Managers after the organisation dropped its flagship 2050 goals amid ESG backlash from the US.

Betashares has launched a global shares and a global infrastructure ETF as part of the firm’s strategic expansion strategy to support financial advisers in building more diversified portfolios.