VanEck’s ETF ‘highly recommended’ by Lonsec

VanEck’s MSCI World ex Australia Quality exchange traded fund (ETF) (QUAL) has received a ‘highly recommended’ rating from Lonsec.

The research house praised the fund for its ability to generate risk-adjusted returns in line with relevant objectives.

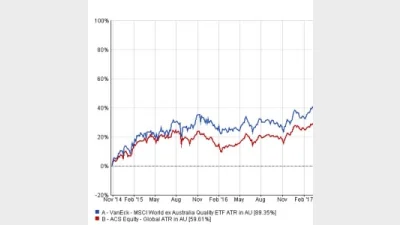

QUAL, which was launched in October 2014, invested in a portfolio of quality international companies listed on exchanges in developed markets around the world (ex Australia) and tracked the performance of the MSCI World ex Australia Quality Index with net dividends reinvested.

According to Lonsec, the fund was the “largest ETF by market capitalisation in Lonsec's global equity 'smart beta' peer group with a resultant uplift in relative liquidity and narrower bid/ask”.

"We are delighted that QUAL has received a 'Highly Recommended’ rating from Lonsec. Through a single trade on the ASX, Australian investors can access a portfolio of 300 quality international companies and achieve attractive risk-adjusted returns, with the potential for outperformance,” managing director VanEck Australia, Arian Neiron, said.

"Since its inception on 29 October 2014, QUAL has outperformed the standard industry international equity benchmark, the MSCI World Ex Australia Index by 2.43 per cent p.a."

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.