No bounce for Lennox after Kangaroo Island fire

Bushfires on Kangaroo Island hindered the performance of the $209 million Lennox Australian Small Companies fund during January as a result of lower tourism numbers.

Writing in a monthly update, managers James Dougherty and Liam Donohue said the fund’s largest detractor from performance came from an overweight position to tourism company SeaLink Travel Group.

Shares in the ferry company, which offers travel to South Australia’s Kangaroo Island as well as other destinations, fell 10.6% during January.

“Shares in SeaLink fell 10.6% during the month on the back of fears that the bushfires around Australia (particularly Kangaroo Island) and the decrease in tourist numbers due to the coronavirus would negatively impact earnings. Since SeaLink acquired [public transport firm] Transit Systems, it has reduced its exposure to tourism.”

The company was also a smaller detractor for Lennox’s $13 million Australian Microcap fund.

The dual impact of the bushfires and the coronavirus was expected to weigh on companies’ performance this reporting season, although the managers acknowledged many companies had already been downgraded.

“We expect many companies will report an in-line result. It feels like any companies that experienced significantly softer trading conditions have already downgraded – there were 25 downgrades in January alone. The most common reasons for downgrading were bushfire impact, competitive pressures/discounting, tighter credit and low consumer sentiment.

“We see risk to retailers, potentially impacted by supply chain issues due to factories shutting in China due to coronavirus fears and those companies exposed to tourism due to a decrease in domestic and international travellers because of bushfires, floods and coronavirus fears.”

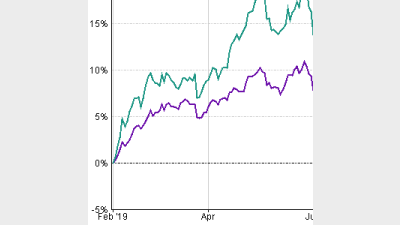

According to FE Analytics, the Australian Small Companies fund has returned 17.9% over one year to 31 January versus returns of 22.8% by the Australia small/mid cap sector within the Australian Core Strategies universe.

Performance of Lennox Australian Small Companies versus Australia small/mid cap sector

Recommended for you

Australian equities manager Datt Capital has built a retail-friendly version of its small-cap strategy for advisers, previously only available for wholesale investors.

The dominance of passive funds is having a knock-on effect on Australia’s M&A environment by creating a less responsive shareholder base, according to law firm Minter Ellison.

Morningstar Australasia is scrapping its controversial use of algorithm-driven Medalist ratings in Australia next year and confirmed all ratings will now be provided by human analysts.

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.