New India Growth Fund targets Aussie investors

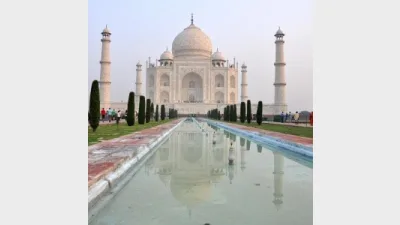

Australian-based Jaipur Asset Management has launched its Jaipur India Growth Fund which aims to offer Australian institutional, professional and wholesale investors who are domiciled in Australia for tax purposes, an opportunity to invest in India while using local expertise to minimise downside risk.

The fund would have a master fund structure which would mean it would eventually invest in up to five select funds, managed by specialist Indian asset managers, who would consequently invest only in listed companies on the Indian Stock Exchange.

However, at the moment this would include only three Indian asset managers such as Birla Sun Life Asset Management, SBI Funds Management and Unit Trust of India, which between them had around $A75 billion under management.

Additionally, the fund said it would be expected to maintain an allocation to each manager in a fixed band between five and 35 per cent, rebalanced quarterly, plus cash holding of up to 10 per cent of assets.

According to Jaipur AM, India currently offered a lot of opportunities to investors as it had the largest population of people under 30 in the world as well as the world’s most populous democracy, which represented around eight per cent of the MSCI Emerging Markets Index.

On top of that, India’s largely domestic consumption-driven economy differentiated itself from other markets while the country’s share market was characterised as ‘wide and deep’, with almost 5,000 listed companies which translated into far less domination by top stocks than in other markets.

Also, India managed to increase its attractiveness in the eyes of foreign investors thanks to the Modi government’s recent changes which included the demonetisation of large banknotes which resulted in pumping around $150 billion into the banking system, the introduction of the goods and services tax (GST) in 2016, the crackdown on bureaucracy and the implementation of infrastructure programs aimed at providing 240 million Indians with access to the banking system.

Jaipur AM said it would be responsible for the selection and monitoring of all the Indian asset managers.

Recommended for you

LGT Wealth Management is maintaining a neutral stance on US equities going into 2026 as it is worried whether the hype around AI euphoria will continue.

Tyndall Asset Management is to close down the Tyndall brand and launch a newly-branded affiliate following a “material change” to its client base.

First Sentier has launched its second active ETF, offering advisers an ETF version of its Ex-20 Australian Share strategy.

BlackRock has revealed that its iShares bitcoin ETF suite has now become the firm’s most profitable product line following the launch of its Australian bitcoin ETF last month.