Lennox sees mixed result from ‘buy now, pay later’ providers

The ‘buy now pay later’ market has delivered mixed results for the Lennox Capital Partners’ managers with ZipCo boosting performance while micro-cap firm Sezzle was a detractor.

ZipCo was held in the firm’s $187 million Australian Small Companies fund and was the top contributor to performance during September after it was added to the ASX Small Ordinaires index during the month.

In a monthly update, managers James Dougherty and Liam Donohue said: “Shares in ZipCo rose 29.5% during the month as it was added to the ASX Small Ordinaries index at the September rebalance. The company also acquired Spotcap for $8.825m, expanding its offering to the small and medium enterprise (SME) space. We also note it was a strong month for all buy now pay later companies with Afterpay up 49.0% and Flexigroup up 40.4%.”

However, this was not the case on the firm’s $12 million Australian Microcap fund where buy now pay later provider Sezzle was the largest detractor with falls in its share price of 5.6% during the month.

Lennox said it believed this was the result of investors taking profits following the company’s IPO at the end of July.

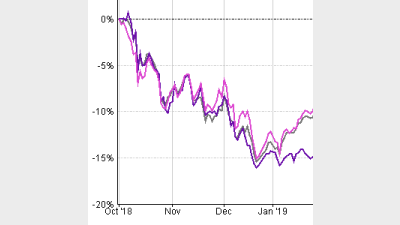

The Australian Small Companies fund has returned 9.3% over one year to 30 September, according to FE Analytics, while the Australian Microcap fund has returned 9.7% over the same period. This compared to returns of 5.5% by the ACS Equity- Australia Small/Mid Cap sector.

Performance of Lennox Australian Microcap and Australian Small Companies funds over one year to 30 September, versus ACS Equity- Australia Small/Mid Cap sector.

Recommended for you

Global asset manager Janus Henderson could be acquired after receiving a non-binding acquisition proposal jointly from a private investment firm and venture capital firm.

Investment manager Salter Brothers has partnered with private equity firm Kilara Capital to launch an Australian sustainable investment platform focusing on decarbonisation.

Fresh off launching three active ETFs to the Australian market, Avantis Investors is already planning to expand its range with two further products next year.

Ausbil is growing its active ETF range with an ESG product in collaboration with sister company Candriam.